Introduction

Introduction

Supply chains today face increasingly frequent and severe disruptions, with causes ranging from geopolitical conflicts and tariff changes to cyber-attacks, pandemics, and natural disasters. These events can abruptly interrupt logistics, production, and deliveries, eroding revenue and margins. Organizations must proactively prepare and build flexibility into their supply chains to protect continuity and enterprise earnings. This paper provides strategic guidance related to identifying vulnerabilities, prioritizing risk-mitigation actions, and investing in resilience initiatives that protect supply chains in the modern era.

Understanding Your Supply Chain

Executive lead strategy must begin with a clear and comprehensive definition of what the supply chain includes. While it is commonly understood as the flow of raw materials and components, this definition is too narrow for effective risk management. A resilient supply chain encompasses all critical enablers of business continuity and profitability.

This includes not only materials and parts, but also the infrastructure, utilities, transportation networks, services, and environmental conditions that support production and delivery. For example, a leather tannery depends on a reliable supply of hides, but also on consistent access to transportation routes, stable energy costs, and functional plant operations. A disruption to any of these inputs, whether from a flooded road, an energy price shock, or a regional labor shortage, can impair output or erode margins, even if core materials remain available.

Effective supply chain leadership requires acknowledging and integrating these less visible dependencies into strategic planning. From sourcing and logistics to facilities and regulatory exposure, each element should be considered part of the supply chain architecture. By broadening this definition, senior decision-makers can more accurately assess operational risk and allocate resources toward long-term resilience.

Gaining Visibility: Understanding Your Supply Chain

The first step in building resilience is to acquire full visibility into the supply chain’s structure and flows. Organizations should have a complete map of the supplier network, manufacturing steps, and distribution channels across all tiers. Without this visibility, it’s impossible to manage disruptions or make informed decisions. In addition, organizations should also invest in data integration and analytics (ERP systems, supplier portals, IoT tracking) so that real-time dashboards and KPIs highlight potential bottlenecks and risk concentrations.

Questions for Achieving Supply Chain Visibility

You can start the process of achieving supply chain visibility by asking a couple of key questions:

- What is our current supply chain configuration?

- Where are our suppliers and production hubs locate

- What inventory buffers and spares do we have

- How do products reach the market?

Clear visibility, supported by up-to-date flow diagrams and performance dashboards, is the foundation for all resilience planning. If your supply chain is not telling you when you are at risk, you are behind.

Which Suppliers, Products, and Markets Are Most Vulnerable?

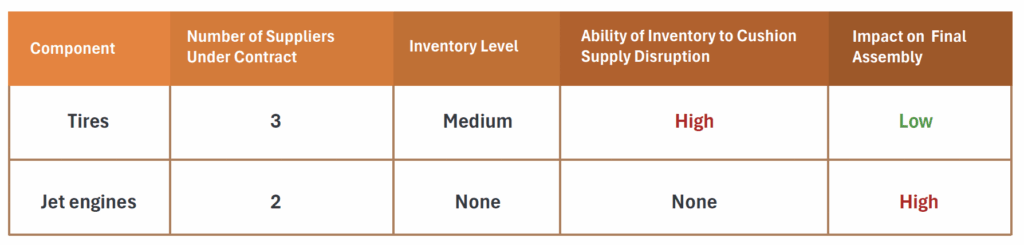

Once the supply chain is mapped, the next step is to assess where it is most vulnerable. Every link could fail, so organizations must be deliberate in analyzing weak points. A useful exercise is to list critical items or nodes and rate each by the number of alternative suppliers, available inventory, and potential impact if delayed. High-risk components with few suppliers and minimal inventory should be flagged for immediate action.

In parallel, organizations should examine contractual commitments as legal terms can impose hidden risks. Sole-sourcing contracts without contingency clauses might lock the company in if the vendor fails, prolonging disruption. Leadership should audit major contracts and aim for flexibility through multi-sourcing clauses and force-majeure provisions,

Organizations should institute formal scenario modeling to prepare for what could go wrong. Assemble cross-functional teams to “war-game” disruptions such as a major supplier factory fire or a pandemic-related shutdown. Evaluate shipment stops, production impacts, and profit losses. However, it is important to note that it is virtually impossible to anticipate and calculate all risks and their probabilities. Therefore, supply chain resilience must be designed not only around known risks but also to withstand serious disruptions in general. This requires embedding resilience principles structurally—irrespective of specific risk scenarios.

This broader approach to resilience design should focus on:

Flexibility and redundancy in product, network, and process architecture

- Complexity management

- Alignment between partners in the supply chain

- Upstream and downstream supply chain integration

- Alignment and integration of internal business functions

- Development and use of intelligence and analytical capabilities to support supply chain and risk management functions

- The presence of appropriate risk management structures, processes, and culture

Scenario Examples

Supply chain disruption scenarios are endless, but here are a few common ones that might stimulate your imagination:

- Natural disaster: Hurricanes, earthquakes, or floods damaging factories, suppliers, or transport routes.

- Cyberattack: Ransomware or denial-of-service attacks halting fulfillment operations.

- Geopolitical conflict: War, sanctions, or regime change blocking access to critical suppliers or trade routes.

- Trade policy changes: New tariffs or restrictions abruptly increase input costs or eliminate vendor viability.

- Pandemics or health crises: Mass illness and lockdowns having an impact on both labor and logistics.

- Supplier financial failure: A key vendor’s bankruptcy stops production and seizes any prepaid inventory.

Each of these scenarios can ripple through multiple layers of your supply chain, compounding delays and cost overruns.

Scenario Prioritization and Risk Modeling

Not all scenarios merit equal attention. Rate each by probability and impact to calculate a risk score. Visual tools like risk matrices help leadership allocate resources toward the most profitable high-impact risks.

Develop a structured contingency plan. Define triggers (KPI thresholds, supplier alerts), designate response teams, and pre-approve budgets for actions like emergency freight or switching vendors. Document both now actions, such as qualifying backup suppliers and triggered actions like shifting orders. This ensures operational readiness without waste.

Seven Proven Strategies for Resilient and Manageable Supply Chains

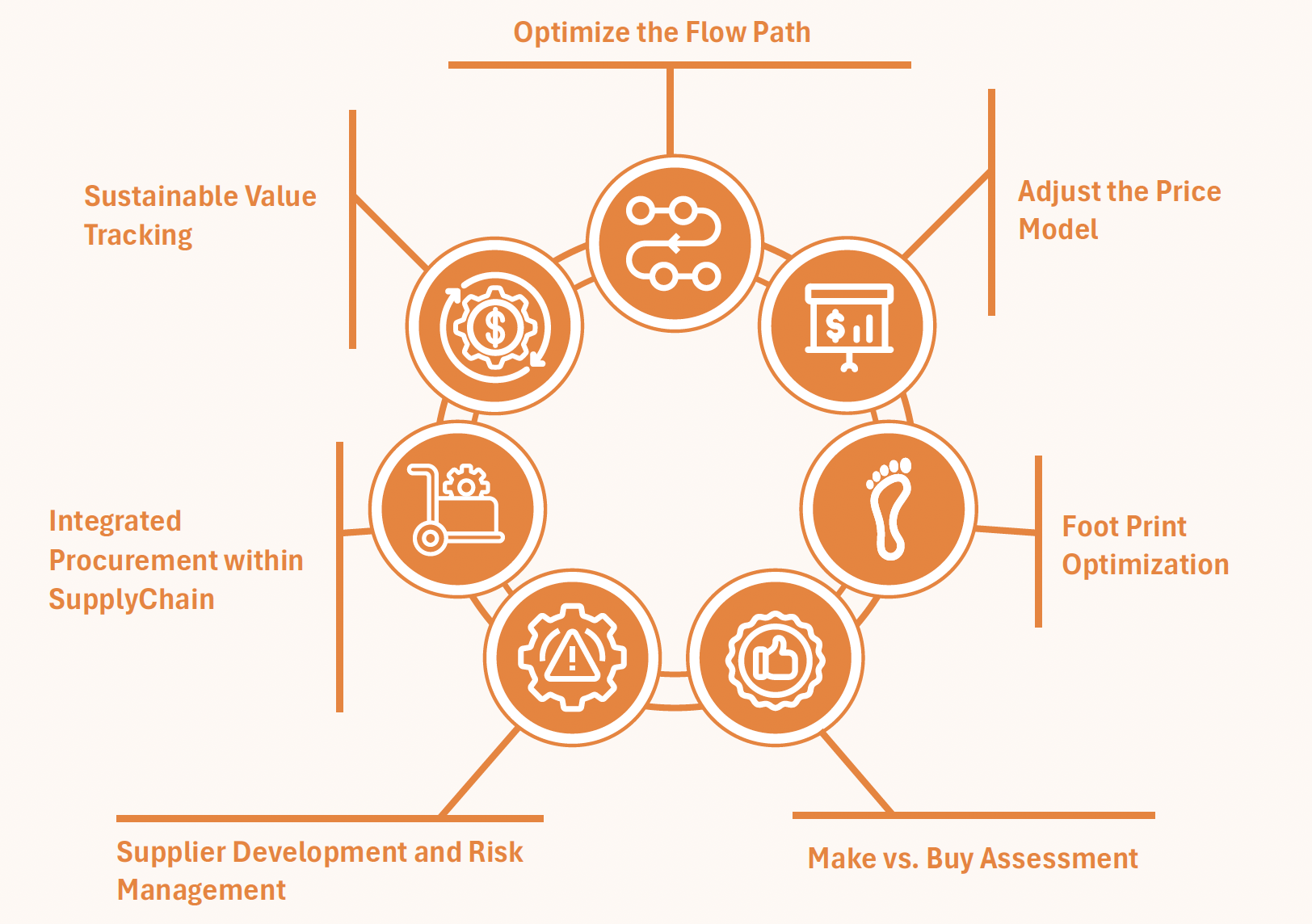

Resilience is not only about reacting to crises but about designing supply chains that can adapt, absorb shocks, and continue to perform. Successful organizations apply the following seven strategies:

1. Optimize the Flow Path

1. Optimize the Flow Path

- Reassess logistics and sourcing: Nearshoring or regional sourcing may reduce risk and improve agility.

2. Adjust the Price Model

- Accept modest cost increases in exchange for flexibility and shorter lead times.

- Align procurement with risk-adjusted ROI, not just lowest price.

3. Footprint Optimization

- Avoid overconcentration of production.

- Cross-train sites or replicate capabilities across regions.

4. Make vs. Buy Assessment

- Evaluate insourcing opportunities where it improves control, quality, or cost-to-serve.

5. Supplier Development and Risk Management

- Invest in key suppliers and rationalize marginal ones.

- Know tier 2+ suppliers and map value streams.

- Supplier development is core to both cost control and continuity.

6. Integrated Procurement within Supply Chain

- Treat procurement, logistics, inventory, and production planning as a single process.

- Break down silos to align freight, cost, and inventory decisions for optimal EBIT.

7. Disciplined Forward Planning and Complexity Management

- Engage in strategic, annual, and SIOP planning.

- Balance product introductions, capacity investments, and outsourced/internal production.

- Understand which complexities add customer value and manage them accordingly.

Each of these strategies involves trade-offs, but they allow leaders to manage volatility and complexity without compromising profitability or customer service.

Measuring Resilience ROI and Staying Competitive

A common challenge for leadership teams is determining whether their current investments in supply chain resilience are sufficient—or excessive—compared to market norms and competitive benchmarks. Without clear visibility into peer strategies, it’s difficult to gauge if resilience spending is driving differentiated value or simply adding cost. We recommend conducting a Resilience Investment Benchmark across your sector to assess how your risk-mitigation efforts (in areas such as supplier diversification, digital monitoring, inventory buffers, and logistics redundancy) compare in terms of intensity, scope, and financial return.

Importantly, supply chain resilience is no longer viewed purely as an operational concern—it is increasingly a board-level, investor-facing priority. Private equity owners, institutional investors, and analysts now scrutinize resilience as a factor in business continuity, cash flow stability, and the ability to respond to market shifts. Management teams are being held accountable for demonstrable risk visibility, scenario preparedness, and recovery speed. A company that can show it has built a supply chain capable of withstanding shocks often commands a valuation premium—because it signals agility, reliability, and protection of customer relationships and margin. In today’s environment, resilience is not just risk management—it’s a lever for enterprise value creation.

Real-World Examples of Resilience in Action

A chemical manufacturer streamlines logistics

A leading chemical producer was experiencing delivery delays and poor responsiveness to order changes, despite having real-time data in its plants. The problem? That data was not accessible to customer service teams or decision-makers.

A comprehensive assessment uncovered four major gaps:

- Suboptimal rail operations: The company lacked visibility into railcar dwell times, total rail costs, and performance benchmarks.

- Fragmented maintenance: Railcar maintenance varied significantly by location, with no consistent program or tracking.

- Inefficient port scheduling: Containers often arrived at ports at the wrong time, leading to nearly $1M in detention fees annually.

- Disjointed inventory reporting: With inconsistent inventory data across North American operations, production planning suffered.

The company launched a targeted 8-week transformation, yielding tangible improvements:

- Fleet sizing and delivery mode optimization: Adjusted fleet sizing and repositioning led to a 20% cost reduction (~$2M), while shifting some customers from rail to truck saved over $1M.

- Rail maintenance strategy: A standardized maintenance program and investment in dedicated infrastructure saved more than $5M.

- Port coordination overhaul: Improved broker alignment and scheduling eliminated the ~$1M in annual detention fees.

- Decision-making tools and SIOP refinement: A process was developed to connect forecasting and scheduling with an existing digital tool, ensuring production aligned with market demand.

The result was a more agile, cost-effective logistics network and a direct improvement in customer service reliability.

An agribusiness firm transforms its supply chain through warehouse redesign

This high-volume agribusiness was operating across a fragmented and inefficient warehouse network. With 17 million cases (over 380,000 pallets) spanning 17,000 SKUs and nearly 130 inventory turns per year, outbound orders to 2,400 customers were plagued by high operating costs and bottlenecks.

A facility consolidation and layout redesign initiative was implemented. The transformation included:

- Consolidating into a single 240,000-square-foot, climate-controlled facility

- Implementing optimized slotting and racking for 24,000 pallet locations, balancing floor and rack storage

- Redesigning material flow to reduce handling time and increase throughput

This restructuring significantly lowered warehousing costs, streamlined outbound operations, and boosted overall supply chain responsiveness.

Water treatment chemical producer reduces freight cost and improves customer service with total logistics network assessment and optimization

This chemical company struggled to manage a larger and more complex fleet following a merger. Multiple transport modes, including private fleet, owner-operators, and common carriers, were operating under a decentralized, reactive dispatching model. The result: frequent emergencies, rising freight costs, and inconsistent customer service.

A deep-dive analysis of the transportation network revealed core issues in routing, load planning, backhaul, and contract alignment. The analysis produced measurable results:

- Converted high-cost lanes from common carriers to private fleet or owner-operators, where volume justified it

- Optimized the production network to reduce shipping distances by aligning plant shipments with nearby customers

- Improved trailer utilization and reduced empty runs

- Consolidated fuel programs and renegotiated vendor terms

- Established KPIs and a central transportation dashboard, enabling proactive management and performance tracking

Together, these actions drove a 15% reduction in freight spend, amounting to $7 million in annual savings, while improving delivery reliability across the network.

These cases prove that resilience strategies can yield measurable financial and operational improvements when treated as executive priorities.

Looking Ahead: Preparing for Continuous Change

Resilience is not a one-time project. Disruptions will continue. What changes is how prepared the organization is.

Resilient supply chains evolve with the market. Leaders must embed risk and complexity management into planning, tie resilience to board-level metrics, and invest in digital tools and adaptive processes. Technology-driven solutions, including artificial intelligence for predictive analytics and ESG-responsive supply chain monitoring, will increasingly define the competitive edge of resilient enterprises.

Conclusion

Supply chains are vulnerable to disruption, and this risk is growing. But with visibility, preparation, and strategic investment, supply chains can become resilient assets. Leaders must treat resilience as a core element of competitiveness. By implementing these seven strategies, companies can ensure reliability, maintain profitability, and strengthen advantage in turbulent environments.

About the Authors

Erik Diks, Partner

Jörgen Wetterberg, Principal

Bruce Work, Partner

Andreas Doerken, Managing Partner

Chip Barth, Partner