We work shoulder to shoulder with CEOs, COOs and CFOs to alter the trajectory of an organization. We create sustainable change by collaboratively eliminating value erosion and negative cash flow generation, while devising and executing a value maximization strategy.

EFESO’s turnaround and restructuring consulting team helps CEOs and Top Management identify and deliver swift, drastic and sustainable operational and financial performance improvement required to preserve and maximize value creation.

As organizations become distressed, the company enters a profit crisis so severe that the organization begins to burn cash at a rate that threats business continuity. As a consequence, a rapid but well-thought-out action plan and urgent execution is required to:

- Reduce cash burn and stop value erosion.

- Formulate a new sustainable value creation strategy rooted in best-in-class operational processes.

- Quickly and effectively execute the strategy to deliver measurable improvement in cash generation, profitability and value creation.

Our Team

For a troubled company, the turnaround and restructuring consulting team provides them a competitive advantage and becomes their most valuable asset. EFESO’s specialists have deep restructuring and turnaround experience as well as a wide range of backgrounds including:

- Former C-level executives with a deep track record in leading major restructuring and turnaround programs with solid and tangible results.

- Business Improvement Specialists who combine deep operational and financial knowledge with experience.

- Industry Experts who have “been there” and built their experience through major transformation programs that restored profitability across a variety of businesses.

Our Framework & Approach at a Glance

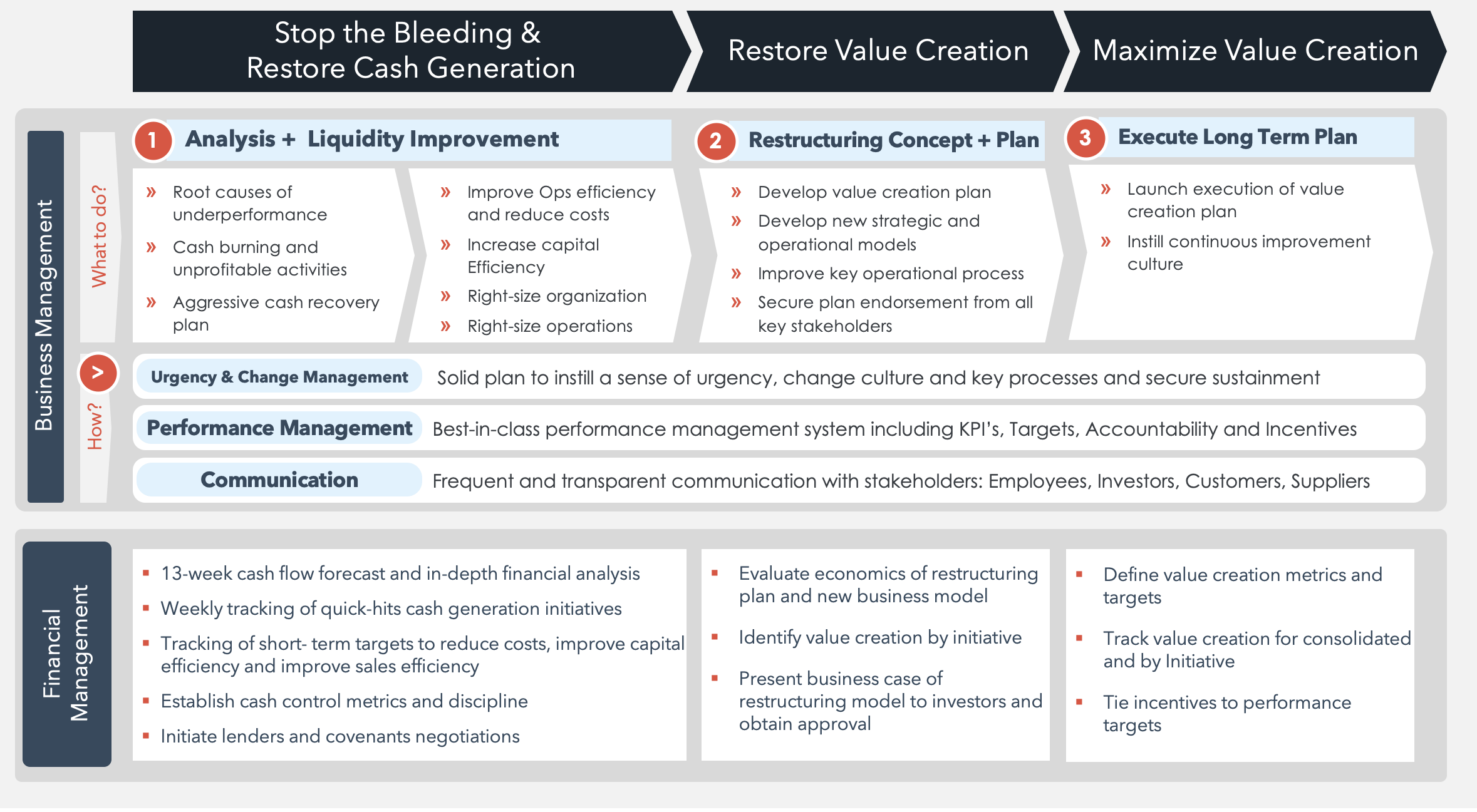

We follow a proven framework and approach combining an interdisciplinary and holistic processes, where operational, financial, and strategic improvements are identified, quantified, and prioritized, then quickly executed with a sense of urgency, to bring the best real-world solutions and capabilities to each unique situation. The approach consists of three critical steps:

- Stop the bleeding and restore cash generation.

- Develop a new go-forward plan, that is credible and sustainable.

- Execute the elements of the new plan, with the company’s management, overcoming the existing cultural inertia that is inherent when things are done differently.

Our Portfolio of Restructuring and Turnaround Services and Approach

Our Portfolio of Restructuring and Turnaround Services and Approach

Our Services Include:

- Development and delivery of Restructuring / Turnaround Concept & Plan

- Complete Analysis of the Existing Business Situation

- Execution of Rapid Cash Management & Operational Liquidity Improvements, including Cost Reduction, improved Capital Efficiency and Revenue Enhancement

- Cash Management and Forecasting Program (including development of a short-term cash flow forecast with cash control metrics and KPI’s)

- Restructuring / Turnaround / Transformation Office to drive discipline, cadence and execution

- Interim Management & Chief Restructuring Officer

- Operational Restructuring Implementation

- Change Management Strategy Design and Implementation

- New Performance Management Strategy Design and Implementation

Our Framework and Approach in Detail

Step 1 – Restore Cash Generation (“Stop the Bleeding”). This process entails x-raying the organization to identify root causes of cash burning and subpar revenue activities and starting the execution of an aggressive cash recovery plan. An integral part of this process is an in-depth evaluation and analysis of business activities to capture short-term liquidity-generating opportunities by working capital management, sale of unnecessary assets, redundant operational cost reductions, capital expenditure delays and elimination, and enhanced revenue generation. The structural phase of Stop the Bleeding will also include a right-sizing of operations and entire organizational structure as a means to 1) balance the organization’s cost structure, that is affordable, with the revised, realistic, future revenue plan and 2) serve as a signal to all key stakeholders of both the necessity and commitment to change.

Step 2 – Restore Value Creation. Once liquidity management is under control and short-term operational improvements are identified and started to be captured, we help our clients to restore and sustain Value Creation by developing the restructuring plan. A solid understanding of the root causes of underperformance is a critical input for this process. The ART team will partner with you and your team to develop a new value creation strategy that addresses all critical root causes of underperformance. This process will result in the definition of a new business and operational model. This phase also includes a clear plan to improve key operational processes and a high-quality financial evaluation of the new strategy that can be communicated to employees, investors and creditors to secure support and optimal endorsement.

Step 3 – Maximize Value Creation. The third step is all about execution of the new value creation strategy. As such, it comprises the definition of well-designed implementation plans in all critical areas, the optimal allocation of human and capital resources and the seamless operation of a robust performance management capability including KPI, Targets, Accountability and Incentive definitions and tracking for all critical initiatives and workstreams. The result will be sustainability of the new plan as demonstrated by the predictability provided by the metrics that are implemented to gage performance.

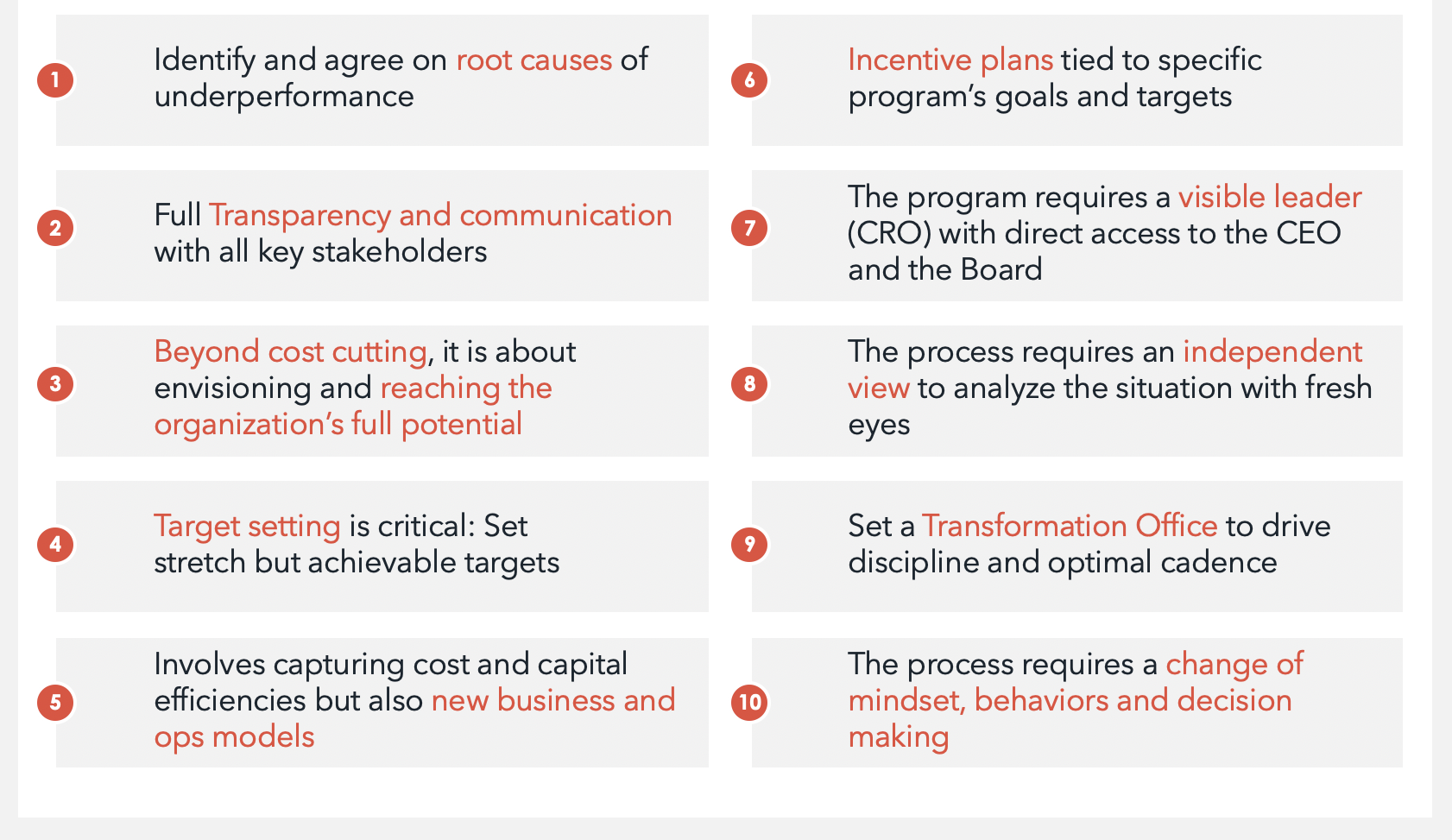

Key Enabling Processes Critical to a Successful Restructuring & Turnaround Strategy

As an integral part of our practice, the following management processes need to be addressed, and, in many cases, prioritized as we execute our Restructuring and Turnaround framework:

Urgency, Change Management & Communication: People and the existing company culture must be placed at the center of the Restructuring and Turnaround Program. When company performance has deteriorated to the point of distress, decision making, management practices and personnel behaviors require change. But change by definition is difficult and contrary to human nature. The question is then, how to drive the organization to overcome this change inertia to perform at the best possible level, while navigating a difficult business environment?

Our consultants help our clients design and execute a deliberate, systematic and superior effort to win people’s hearts and minds and change mindsets, processes and behaviors. We use proven Best-in Class Change Management practices to mobilize the organization and achieve cultural change. Our approach includes:

- Defining and communicating a compelling case for change across the organization and key stakeholders.

- Identifying and addressing all business and management factors generating suboptimal behaviors.

- Appointing best leaders and talents in key roles across the program.

- Setting the Restructuring and Turnaround office to drive actions, set the pace of the transformation and communicate issues and progress.

Performance & Financial Management: “What gets measured, gets managed” and management is required in high doses during a Restructuring Program from beginning to end. Our team makes sure that people, processes and tools are put in place during the engagement to

- Track the right metrics at the right moment.

- Set ambitious targets proportional to the need for change.

- Ensure accountability for all key initiatives and 4) align business and individuals’ objectives through optimal definition of financial and non-financial incentives.

A solid financial management workstream is also required throughout the process to:

- Drive the cash management phase and secure robust cash controls

- Evaluate the economic and resulting return on capital of the new value creation strategy

- Measure the level of value creation delivered to the bottom line during execution.

In Summary

Well designed and executed Restructuring and Turnaround Management programs make the difference between survival and liquidation. When circumstances require, our team is ready to partner with you and your organization to help successfully navigate the restructuring process and position your business to win the future. We advise on every aspect of the journey from Cash Management to Operations Improvement to Restructuring Concept and Value Strategy Development. We are committed to your success and confident that our experience and best practice approach will make the difference you need.

EFESO Best Practices for Executing Restructuring & Turnaround Programs