An array of challenges around the world — tariffs, economic concerns, global conflicts, and still-volatile supply chains — are applying upward pricing pressures on private equity firms and their holdings, forcing them to intensely examine and gain control of their procurement activities.

The Solution:

With a data-driven approach, many PE firms are generating returns of up to a 50% EBITDA increase by lowering procurement costs across the lifecycles of their investments:

- Direct spend reductions of 5-10%

- Indirect spend savings of 20% or more

- Design- and/or process-related spend initiatives that result in lower-priced goods, elimination of some SKUs entirely, and/or reduced volumes of components and materials needed per product

Given the complexity of procurement—driven by the volume, diversity of spend, and multiple influencing factors—private equity firms and their portfolio companies benefit from a structured, analytics-driven sourcing strategy. Leveraging AI-enabled tools such as spend analytics (e.g., purchases by business unit and category) and technical analytics (e.g., part drawings and 3D model assessments), organizations can uncover significant cost-saving opportunities and mitigate supply chain risks. A strategic and operational sourcing approach can often contribute to as much as 30% of a PE firm’s overall value-creation target, with potential for 20% or more in direct piece-price.

Private equity (PE) firms deploy a range of broad-reaching initiatives and operations improvements to maximize value creation in their holdings prior to sale. Much attention also should be given to optimizing their procurement spend, especially as global challenges are applying upward price pressures: U.S. tariffs and retaliatory tariffs are dramatically pushing up procurement costs in many regions and for all manner of products. These actions, combined with instability in the Middle East, Ukraine, and elsewhere are fueling economic concerns for inflation, recession, and continuing currency fluctuations (in April the U.S. dollar hit a three-year low). Add in still-volatile supply chains, long lead times, material shortages, and rising material and freight costs, and procurement activities are increasingly under intense scrutiny.

As PE firms try to de-risk procurement for their portfolio companies, they’re also finding spend reductions that generate substantial compounded savings — up to a 50% EBITDA increase — to offset macro headwinds impacting their bottom lines. The consensus among PE executives is that optimizing procurement, especially direct and indirect spend, is a significant value-creation lever and a “no brainer.” To ignore these opportunities is to destroy value.

Key procurement levers driving EBITDA impact for PE firms include:

- Direct spend accounts for as much as 70% of procurement costs in many PE firms’ industrial portfolio companies. Even large organizations with well-established procurement practices can find reductions of 5-10%.

- Indirect spend, though a smaller percentage of overall procurement costs, still offers potential savings of 20% or more, especially when it’s possible to leverage competitive bidding and auctions for services such as IT, MRO, office supplies, and utilities. An additional possibility in this field is the bundling and outsourcing of those indirect functions that are similar in every company.

- Design- and/or process-related spend initiatives (redesigned products, reconfigured processes, and/or standardized purchased goods) can lead to lower-priced components and materials, elimination of some SKUs entirely, and/or reduced volumes of components and materials needed per product. For example, a part redesign might reduce the number of components involved (10 bolts compared to 20) or the weight of parts by using different raw materials.

- PE firms pursing a build-and-buy strategy will find opportunities to leverage procurement spend across their multi-company platforms, capturing economies of scale as their portfolios grow.

These initiatives always should be undertaken along with the setup of a competitive organization (i.e., category management) and processes and systems that work across regions.

Always Present Procurement Opportunities

Even if procurement optimization has not been a focus for a PE firm, any time is a good time to start; it boosts returns across the lifecycle of a PE firm’s holdings and even prior to investing. During operations due diligence, it’s a priority to determine the potential value creation possible via procurement improvements at the target company — or potential value loss when buying carve-outs that may no longer benefit from an integrated, cross-company procurement approach.

Early- to mid-cycle PE holdings represent the “sweet spot” for procurement savings. While value-creation during this period is often focused on big projects — reorganizing assets, changing a company’s commercial approach — changes to procurement deliver multiple years of repeated savings. But even during this stage it should not be a one-off event but an ongoing management practice, as product and service innovations regularly emerge and pricing structures constantly change.

Lastly, holdings nearing exit dates often still present opportunities for rapid procurement savings, especially if PE firms have been consumed with growth-focused improvements (e.g., ERP implementation, operations overhaul/transformation) and not sufficiently examined spend. It’s never too late to capture more value or to identify and size the next wave of procurement improvement opportunities in preparation for exit. And buyers will want EBITA impact even if it occurs after they acquire a company.

PE firms that generate the greatest savings from procurement optimization typically rely on data-driven processes that identify savings while also ensuring development of a supplier network capable of supporting their growth strategies (i.e., switching to smaller, cheaper suppliers that may not keep up with growing volumes is a risk not worth taking). The analysis of procurement spend will focus on:

- Suppliers: Has decentralized purchasing resulted in a fragmented supply base, with too many vendors providing the same or similar products? Have legacy relationships resulted in too few suppliers and not enough backup options? Are all suppliers held to the same audit criteria and appropriately vetted?

- Purchase patterns: How have purchase prices trended over time? Do price trends align with market trends?

- External influences: Amid the chaotic tariff environment that few executives have ever encountered — no longer specific to certain goods and instead targeting countries and entire sectors — what options exist to minimize the impact to procurement pricing? What material and component innovations could appreciably alter a company’s bill of materials?

- Addressability: As much as one-third of a company’s spend could be off limits for optimization. Component pricing may be tied to a bundle purchase, or customers have specified certain material/components and/or vendors that must be used.

Once procurement savings have been identified, they need to be realized, and the timing can vary considerably: Some savings are quick wins, such as low-stock items that can immediately be replaced without negotiations and contracts. Many high-impact categories require longer lead times to execute across the company, such as part standardization, part and process redesigns, and/or the cancelling of contracts and negotiating new deals. Revising purchased goods in some highly regulated industries, such as pharma and F&B, can require lead times beyond a year.

Challenges Capturing Procurement Savings

Given the sheer volume and diversity of spend possible and myriad factors involved, many portfolio companies simply lack the strategic procurement capabilities and resources to achieve optimum savings, including:

- Effective purchasing governance and centralized procurement structure

- A robust strategic sourcing approach, executed by experienced procurement professionals

- State-of-the-art tools and technologies to regularly assess and aggregate spend

- Visibility into their supply chains and pricing knowledge of available, potential suppliers

- Adequate procurement leadership and staff knowhow

- Ability to identify and quickly leverage key spend drivers

- Skills to effectively negotiate and contract with suppliers

Addressing procurement skill and capacity gaps is essential for private equity firms aiming to reduce spend, improve EBITDA, and drive stronger returns. Effective procurement strategies require not only technical expertise—such as spend analysis, category management, supplier identification, RFQ and bid evaluation, and negotiation tactics—but also sharp business acumen. Staying attuned to evolving market trends, risks, and opportunities is critical to shaping resilient, value-driven procurement approaches that align with overarching investment goals.

A strategic and operations-execution approach to procurement also includes an AI-enabled analytical toolbox that rapidly defines savings in ways previously not possible:

- Spend analytics: Match spend cube (e.g., unit price and quantity, category of spend, supplier) with external data input (currency developments, raw materials, tariffs, import duties, etc.) to determine areas of past overpayment compared to contracted pricing, credits due, and future potential savings.

- Technical analytics: Leverage AI non-linear price progression models to quickly review part drawings and 3D models for a part similarity assessment (e.g., dozens of different part numbers for basically the same part) and to identify price outliers and future part standardization and savings.

- Additional AI tools: Establish premeditated cost models that quickly assign proper costs based on bottom-up cost calculations culled from some 15 million manufacturing suppliers at our fingertips.

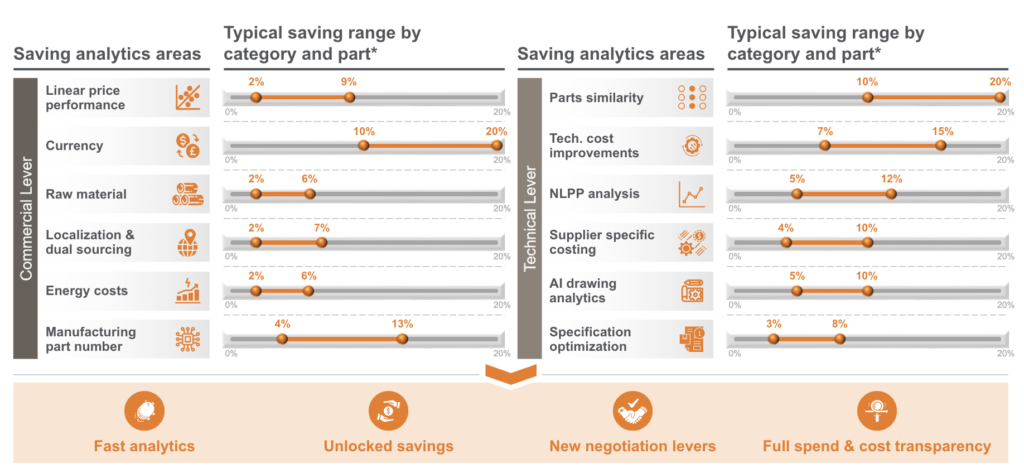

Working alongside portfolio companies’ management, we hit agreed-to savings targets that tie back to the P&L. EFESO engagements often generate savings amounting to 30% of the overall value-creation usually required by a PE firm. For example, a major AI-backed cost-down project for an off-highway automotive company culminated with three weeks of negotiations involving 175 suppliers and generated €30 million (approximately 11% in bottom-line savings) with a return on consulting of greater than 30:1. Within six months we implemented spend changes at another portfolio companies nearing its exit date resulting in $2 million in procurement savings (20-30% additional value for the company and 10-15X EBITDA). An EFESO procurement optimization typically results in 20% or more piece-price reductions via a combination of commercial analytics levers and technical analytics levers per part (see Exhibit 1).

Exhibit 1. EFESO Piece-Price Reduction through Strategic Sourcing by Lever

* Each part can have multiple saving levers; not all levers apply to a part.

While delivering high procurement savings, we also ensure that supplier-network changes are capable of enhancing growth for the company (a sizeable portion of value creation is usually savings, but the majority will need to come from growth); our approach and operations expertise optimizes procurement and enhances growth and the capture of associated economies of scale. And as we work with existing procurement staff and the functions that influence procurement decisions (e.g., engineering, production, design), we establish more sophisticated procurement practices, processes, and analytical tools that ensure savings are sustained and improved — transforming decentralized buying into a strategic sourcing organization managed by improved and informed procurement staff.

Experienced procurement guidance is more important today than ever given the rapidly changing global trade environment. With a network of some 1,100 consultants around the globe working in virtually every industry, we bring expertise specific to portfolio companies and their suppliers wherever they’re located and whatever they’re buying.

About the Authors

Andreas Dörken, Managing Partner, heads globally the Private Equity and the Process Industry practices. He has more than 30 years of experience working in industrial firms and consulting.

Fabian Rodriguez, Partner, Co-Leader Private Equity Practice Americas, has over 20 years of global experience in value management, value strategy, and operations. Fabian is a trusted advisor and an expert in maximizing company value for leading Private Equity Firms.

Dr. Kenneth Sievers, Partner & Member of DACH Management Team, has over 20 years of experience in procurement and SCM, profitability programs and organizational development. Kenneth is a trusted advisor and an expert in driving profitability for his clients.

Jamie Loder, Partner, Private Equity Practice, has over 20 years of global experience in private equity both as an investor and as a consultant. Jamie is first and foremost a procurement practitioner but with strong emphasis on cross functional value creation across the operational value chain.

Niklas Lübker, Principal, Procurement Practice DACH, has over 15 years in global experience procurement, savings realization, and digitalization. Niklas is well known expert in procurement.

Matt Romzek, Manager, has 7+ years of experience in consulting and industry, with a focus on procurement, supply chain, and operations. Matt has helped clients achieve tangible results, from auto & industrials to F&B.