A Successful MRO Distributor Restructuring & Turnaround Program

Background

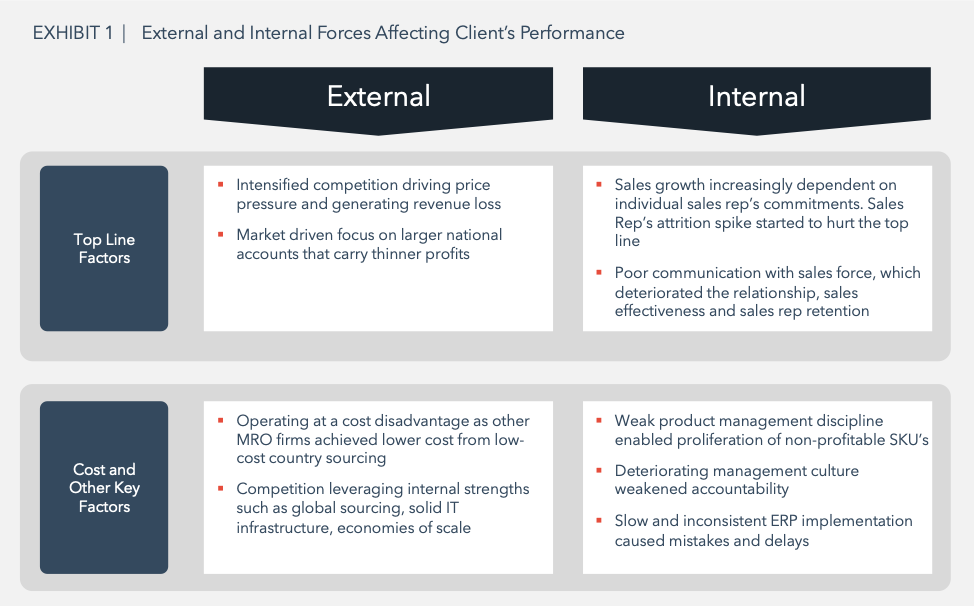

A middle market publicly traded MRO (Maintenance, Repair and Overhaul) distributor was facing declining profits, cash flow shortages and spiraling debt. The company had a strong brand name which allowed it to command premium prices in their 350,000+ SKU’s in multiple categories (fasteners, abrasives, hydraulic products, paints, others). However, since 2016, the company started facing gradually declining sales and increasing costs due to a number of external and internal reasons as shown in Exhibit 1 below:

Traditionally in this sector, the largest MRO distributors have excelled due to specific operational capabilities such as superior supply chain, IT tools, or global sourcing and negotiation power, whereas middle market and smaller competitors have competed on their ability to achieve better customer intimacy.

Traditionally in this sector, the largest MRO distributors have excelled due to specific operational capabilities such as superior supply chain, IT tools, or global sourcing and negotiation power, whereas middle market and smaller competitors have competed on their ability to achieve better customer intimacy.

ARGO-EFESO’s Role and Impact

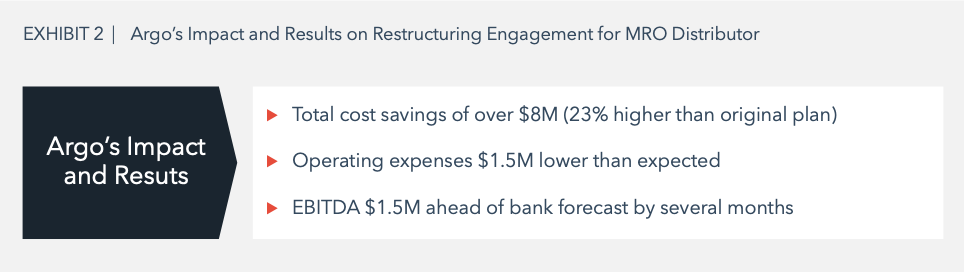

ARGO-EFESO was retained to review and strengthen the overall restructuring plan and provide practitioner expertise in supply chain. In partnership with the client’s management team, ARGO-EFESO reworked and oversaw an aggressive restructuring plan and identified and implemented operational improvements leading to the following results:

Step 1: Understanding Client’s Situation and Review Existing Plan

Before ARGO-EFESO ’s involvement, the firm had already noticed the need to revamp their strategic plan and focused on five key priorities to improve deteriorating results:

- Reduce churn in legacy customers

- Open more locations

- Accelerate acquisition of strategic accounts

- Increase share of wallet in current accounts

- Acquire more mid-market customers

To achieve these objectives, management pursued a number of initiatives, including:

- New ERP system implementation

- Network analysis and consolidation of warehouses

- Development of a new pricing structure

- Increase in the sales force and realignment of regions

Unfortunately, before the company was able to gain traction with the new strategic plan, they faced an accelerated weakening of results.

- Profitability levels fell from $7M (net income) to -$1.7M by close of 2017.

- Free cash flow went from positive $5M to less than -$10M.

- By 1Q 2018, the company had drawn $14M from a pre-approved line of credit; burning through $7M in cash per month.

- Steep decline in stock price — from high of $25/share to $14/share in 8 months.

Review of Existing Plan, Our Conclusion: Not Aggressive Enough

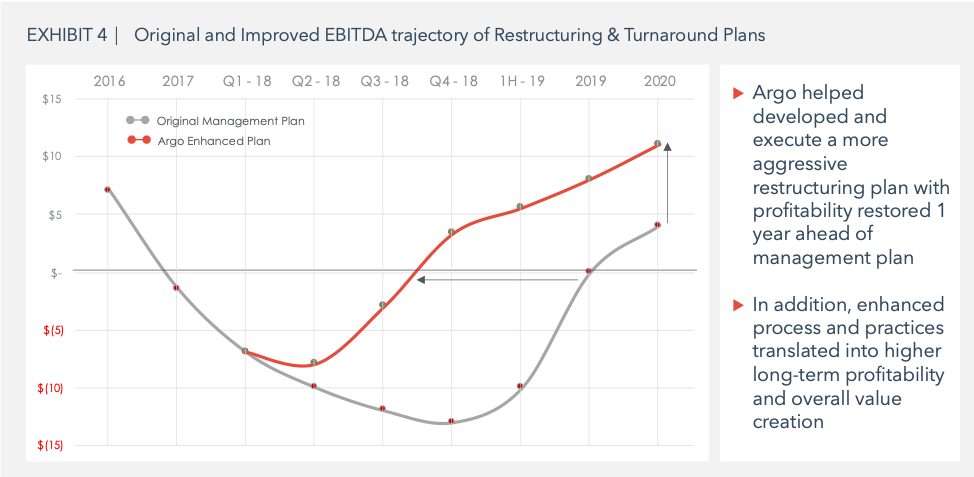

In response to the situation, management prepared a restructuring plan during the first quarter of 2018.

- The plan included a number of layoffs but did not include critical process improvements or top management structure changes.

- The plan forecasted a loss of $13M for 2018 and break even (on an EBITDA basis) for year 2019.

In both the board’s and their banker’s eyes the plan was not aggressive enough to turn around the business without further damage to their position on the market.

ARGO-EFESO came in to analyze the management plan, the current state of operations and to put together a faster turnaround plan. Within three weeks, ARGO-EFESO confirmed that most of the problems originated from a lack of top down accountability, lack of an execution methodology, a proliferation of complex management initiatives, and a deteriorating relationship with the sales force. Although management was aware of these issues, it appeared to lack the execution capability to solve them.

Step 2: Revamp the Plan, Bring in Governance, Excel in Plan Execution

ARGO-EFESO ’s solution focused on a number of initiatives which included revamping the company’s current restructuring plan, following discussions with management where we expressed concern that the current plan would fall short and it would not be welcomed by investors and creditors.

With that in mind, ARGO-EFESO brought in a Chief Restructuring Officer and a supply chain expert team to lead the turnaround. The immediate plan focused on:

- Instituting a daily Restructuring Command Center to rework the current plan and stress its urgency.

- Highlighting the organization’s top-heavy structure (with many high earners) — to achieve the right numbers and improve execution, a firmer approach would be necessary.

- Making the necessary changes to drastically alter the financial projections to achieve a break even by end of 2018 and turn a profit by 1Q 2019.

- Leading a daily discussion and analysis of revenue and cost leakage as well as lack of execution control.

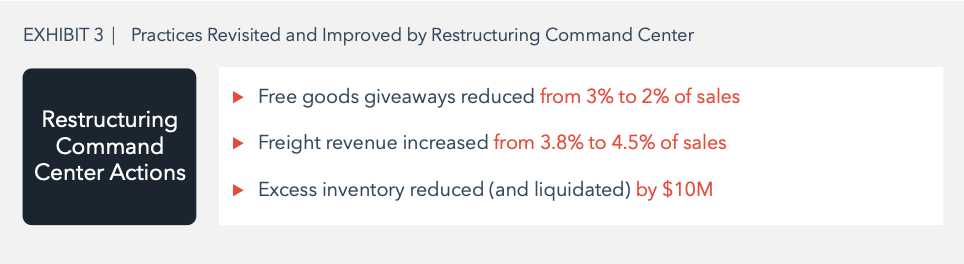

The Restructuring Command Center identified and revisited practices that were accepted as normal but had a negative operational impact. Improvements identified and captured are shown in Exhibit 3 below:

Other Initiatives: Beyond Cost Cutting, Enabling Processes & Capabilities

Other Initiatives: Beyond Cost Cutting, Enabling Processes & Capabilities

ARGO-EFESO led other critical initiatives that streamlined processes to enable headcount reductions and that addressed areas of low skill and poor performance such as procurement, sourcing and supply chain. The total savings from these other initiatives were approximately $8M.

To support these initiatives, ARGO-EFESO deployed several operations/supply chain experts in specific areas to work with company teams. These initiatives included:

- Analysis and redesign of special products sales, to maximize the value provided by this product category and to minimize non-core efforts.

- Evaluation and redesign of the credit approval process.

- Improving the sourcing and purchasing processes to leverage volume in negotiations, achieving savings of $3.5M.

ARGO-EFESO also stepped in when an unexpected situation arose. The project manager of a consolidation project resigned. ARGO-EFESO assigned one of its internal logistics experts to fill in that critical position for a period of 7 months

Step 3 Realizing Tangible Results

Following ARGO-EFESO’s action, the client adjusted its course during 2018 and proceeded with a successful two-phase headcount reduction program in June and November. A disciplined and systematic focus on all key components of the P&L allowed better than projected month-by-month outcomes.

- Realized labor savings of $900K by June, which helped achieve a $400K higher than planned EBITDA that month.

- By the end of 3Q, sales maintained a sustained trend while operating income was almost at break-even versus a projected loss of almost $2M for the quarter. EBITDA also ended in positive terrain at about $500K versus a projected $200K loss.

- By October, when the results came in, the company’s management team and staff were enthusiastic and had a much more positive outlook as results were getting closer to break even.

The financial highlights of the fourth quarter validated ARGO-EFESO’s expectations:

- Operating expenses $1.5M lower than expected, which supported an operating income of $3M.

- EBITDA came in at $3.3M — $1.5M ahead of bank forecast.

- Outstanding net debt was showing signs of stability and bottoming out.

Towards the end of our project, a new CEO was brought in who understood the actions put forth by the restructuring committee. He supported the ongoing plan and became an active member of the accountability sessions.

Methodology

ARGO-EFESO worked closely with management to:

- Identify the most important root causes of the performance deterioration.

- Surface complex issues and questions not actively discussed by the management team.

- Instill a sense of urgency during the daily performance meetings and push a bias for action for critical decisions.

- Install the Restructuring Command Center with the CEO and members of the executive team

Part of our work was also framed around a team approach to solve operational day-to-day problems. Starting with daily sessions, ARGO-EFESO brought together members of different departments to map key processes that needed redesign to eliminate unnecessary work, streamline activities, and reduce headcount for the restructuring plan. These sessions were highly interactive, and we were able to implement several short-term measures to impact process indicators quickly and significantly.

About the Authors:

Fernando Assens is ARGO-EFESO’s Managing Partner and a co-leader of its Private Equity Practice. He focuses in Industrial and Distribution companies. [email protected]

Jorge Mastellari is Senior VP and Partner at ARGO-EFESO. His background spans across multiple industries ranging from Industrials to Private Equity and Oil & Gas. Prior to joining ARGO-EFESO, he was a Project Manager with McKinsey & Co. [email protected]

David Bilby is a co-leader on ARGO-EFESO Private Equity practice. Prior to joining ARGO-EFESO, he was a Senior Director at Alvarez & Marsal. [email protected]

Fabian Rodriguez is a Vice President at ARGO-EFESO’s Private Equity, M&A and Restructuring Practice. Prior to joining ARGO-EFESO, Fabian was a Senior Vice President at Stern Stewart & Co. and a Senior Associate at A.T. Kearney. [email protected]