Companies consider Working Capital Management (WCM) as a strategic priority to generate cash. This is impacted mainly through Cash Conversion Cycle (CCC) which is the key factor of a good working capital management. This is proving to be of paramount importance especially now during the Covid-19 pandemic. Companies are preserving cash in these uncertain times and as a result, management wants to extract cash from balance sheet instead of seeking external financing. Improving the CCC is a way of freeing up cash during these uncertain times.

The cash conversion cycle is defined as a metric that expresses the length of time that it takes for a firm to convert resources into cash flows. Or stated another way, how quickly can a company convert its products into cash through sales. It is expressed as the sum of Days Sales Outstanding (DSO) and Days Inventory Outstanding (DIO) minus Days Payable Outstanding (DPO)

CCC= DSO+DIO-DPO

Days Sale Outstanding (DSO): is a measure of the average days a company takes to collect cash after the sale of the product or service. A low DSO means that it takes a company fewer days to collect its receivables. DSO can also be a ratio that measures how effective the company is bringing money in. DSO is calculated as follows:

DSO = (Average Total Receivables / Sales) * 365

Days Inventories on Hand (DIO): How long it takes for a company to convert its inventory into sales. Lower values of DIO are favorable to the company. However, inventory must be kept at safe level so that no sales are lost because of stock-outs. This is highly dependent on the industry as an example a supermarket that sells fruits have low inventories while automobile industry has huge values of stocks. DIO is calculated as follows:

DIO = (Average Total Inventories / Sales) * 365

Days Payable Outstanding (DPO): is a measure of the average days a company takes to pay in cash to the supplier after the acquisition of a product or service. A low ratio means that there is a long time between the act of purchase and the payment to suppliers what gives to the company extra liquidity. This ratio also varies with the industry, the period of the consumption of the goods, e.g. payment for project in building industry takes longer than one in fast moving consumer goods industry.

DPO = (Average Total Payables / Cost of Sales) * 365

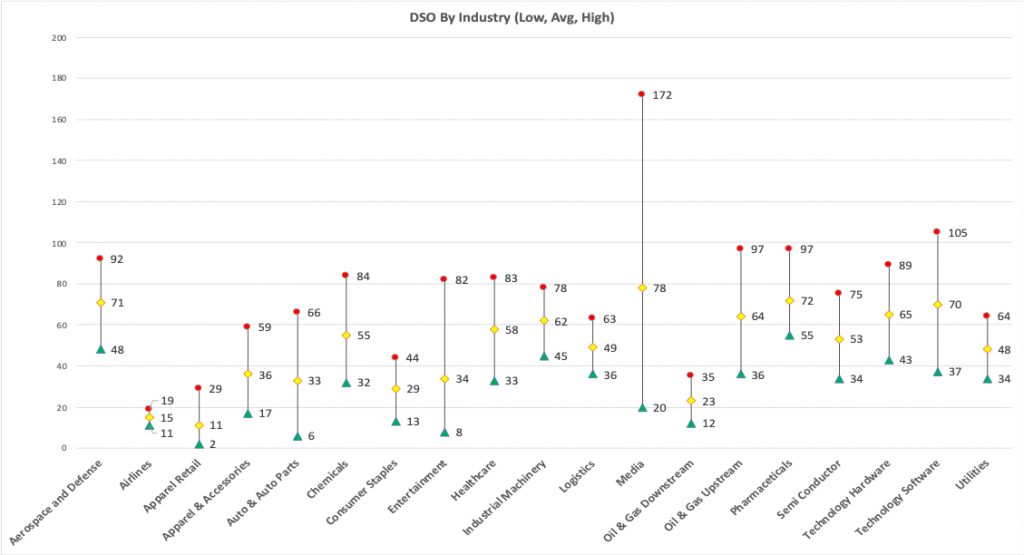

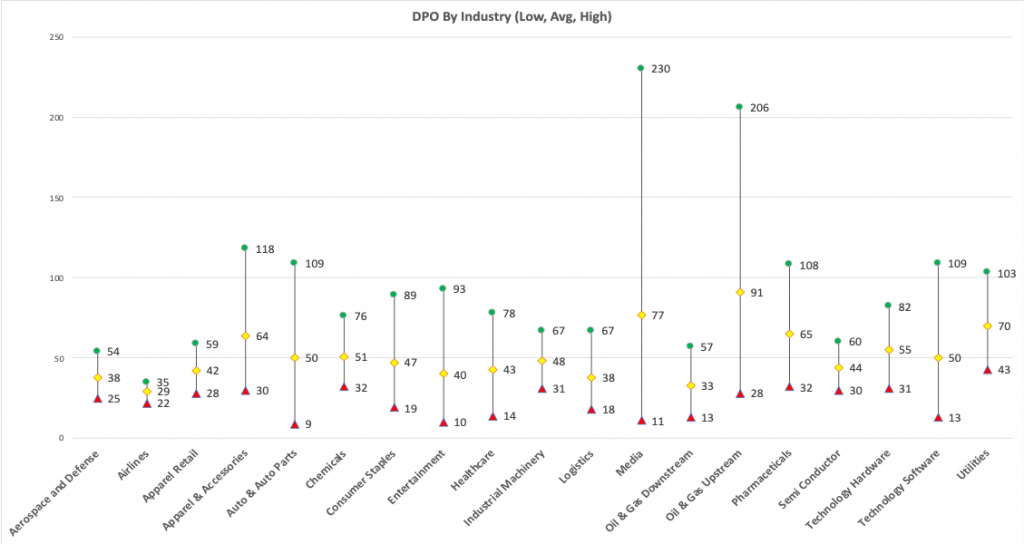

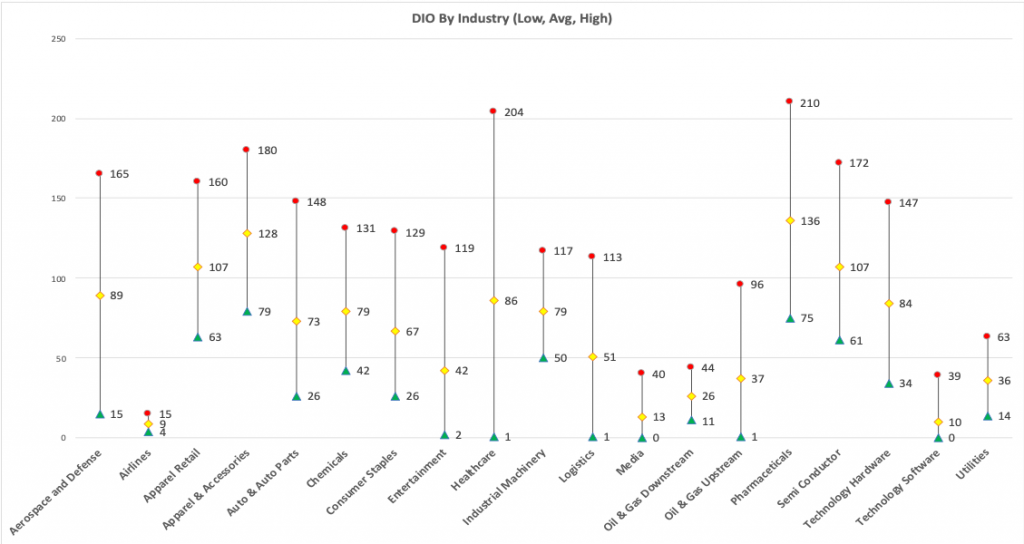

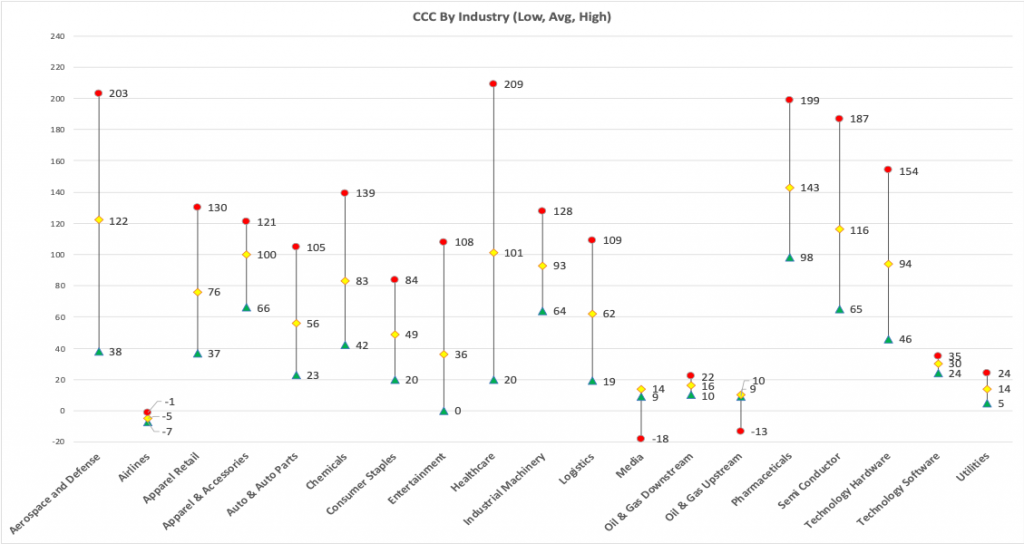

Benchmarking your current CCC and how you measure up within your industry is important in understanding how effective the organization is at converting cash. Below are 19 industries and their associated indices that make up CCC.

The range of DSO, DPO, DIO and associated CCC by industry:

Setting internal targets is essential in meeting goals and understanding where your organization is in terms of benchmarks is an important first step. However, making improvements can be a daunting task especially when the organization is in the midst of crisis management or day to day operations. Making improvements should be undertaken since measuring and correcting DSO, DPO and DIO will have immediate impacts to your cash position.

Ways to improve DSO:

- First and foremost, measure DSO frequently and set targets and understand reasons for not meeting targets.

- Expand ways customers can do business with you such as ability to pay with credit cards, online options, payment portals or payment plans for strong customers.

- Offer incentives for customers to pay earlier such as discounts and penalties for late payments. Ensure payment terms are consistent and aligned with industry best practice. Adjusting payment terms and reducing amount of different terms can make it much easier to manage and provide the biggest impact to DSO improvement.

- Know your customers credit risk and identify parameters that are acceptable or in line with DSO target. On board your sales personnel and align incentives and penalties to your credit requirements.

- Slow or inefficient invoicing process as well as inaccurate invoices can add days to your DSO process.

- Have a robust system to manage accounts receivable and review frequently with associated follow up and communication. Ensure a collection system.

Ways to Improve DIO:

- Conduct an ABC analysis based on consumption values combined with as XYZ analysis on consumption frequency using the 80/20 rule. A items are typically 80% of inventory value and make up 20% of your items, B items 15% of value make up 30% of items and C items have 5% of value and make up 50% of items – similar to X, Y and Z items. It is interesting then to combine the two views. Define a specific inventory and repositioning strategy for each of the 9 buckets. Understanding this framework lays the foundation for action to remove and reduce your inventory position.

- Conduct a slow moving or obsolescence assessment and sell unused inventory at reduced cost or resell unused inventory back to suppliers at a discounted rate if applicable.

- Improve forecasting, understand supply chain lead times and variability and recalculate inventory safety stocking levels. Improving or installing an SIOP process will have a dramatic impact on inventory stocking levels.

- Evaluate current MRP rules for reorder and consider Kanban applications where applicable. Controlling the procurement of inventory with a robust and monitored system will ensure purchases are made based on data and not tribal knowledge. Consider Hybrid systems of MRP and Kanban which can be effectively utilized if proper categorization has been conducted. Kanbans are highly effective as they are visual and based on pull system instead of a push system of replenishment.

Ways to Improve DPO:

- Analysis payments and identify early payments before due date of terms and those that have immediate payment terms.

- Ensure system vendor master files and associated terms are in line with invoice and correct any discrepancies.

- Standardize policy of advancing payment terms even when terms exist. This becomes an easier proposition in times such as Covid-19 where many more payments of others will be in default.

- Utilize discounts being offered only if total of discounts are positive with regard to cash position.

- Consider going paperless.

The Covid-19 pandemic requires organizations to seriously look at available cash. The opportunity to improve the Cash Conversion Cycle by managing differently the elements that contribute to it will provide much needed capital in this time of uncertainty.