Business Response to the Coronavirus

COVID-19 – The Impact

Most business in the world has been severely affected by the COVID-19 Pandemic. In addition to the constant threat of well-being and even life, businesspeople have lost their mobility, and have significantly curtailed the direct, face to face, interaction with customers, suppliers and other employees. This loss of familiar interplay in day to day activities has caused much inefficiency in even routine requirements of the business and has only been ameliorated in some industries by a more prominent use of technology.

But the greatest impact on the businesses has been the loss of revenue. The top line has been decimated because of the cessation of the normal business activity of buying and selling. This is a global phenomenon which is the by-product of country, federal, state and local containment measures, necessarily imposed to restrict the transmission of the highly contagious disease. No one can predict when things will return to normal. Revenue has disappeared by government decree in an attempt to save lives!

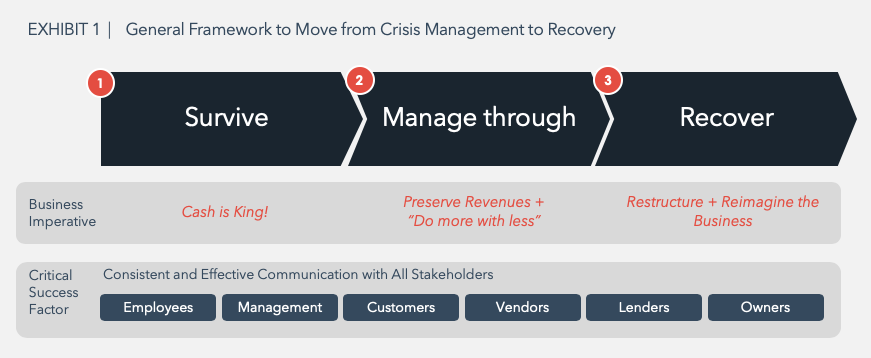

So, businesses must first survive, manage through the crisis, and then recover. Survival will depend on achieving sustainable liquidity until there is enough clarity to predict the return to normalized commercial activity, and then, an assessment of how much time it will take for a full recovery to occur. When will we have predictability? Survival will depend on focused cash management: bringing in cash and reducing or delaying expenditures. Managing through the crisis involves identifying and executing all business changes required to sustain survival until the end of the crisis. The speed of the recovery will define the future scale of resources that the business can afford. Survival, managing through the crisis, and recovery will require elements of business restructuring and business model redesign.

Throughout this three-step process (survival, managing through the crisis and recovery), the business must communicate continuously and effectively with all stakeholders of the business: Employees; Management; Customers; Vendors; Lenders; and, Owners.

All business activity must be focused on: Liquidity, Managing and Communicating through the crisis and Restructuring, Reengineering the business model.

I.Survival – Cash Is King!

Cash planning starts with a 13 week rolling cash forecast, designed to answer three questions:

- Do I run out of cash and when?

- How much cash is required?

- For how long will this be needed?

Since no one has a crystal ball, we recommend developing a forecast based on a stressed revenue forecast and conservative expenditures. During this process, ideas must be developed regarding possible sources of cash inflows and opportunities to defer or eliminate expenditures. Specific areas to explore for cash generation and preservation are:

External Sources of cash

- Drawdown of existing loan facilities

- New loan proceeds

- Governmental COVID-19 relief programs; e.g., SBA loans, CARES Act, Other state and local assistance.

- Equity or structured equity proceeds

- Private Equity minority investment or part of a planned “creeping acquisition”

Internal Sources of cash

- Acceleration of accounts receivable collections and dynamic assessment of associated credit risk

- Sale of underutilized or idled assets

- Inventory reduction

- Payroll reduction through benefits reductions, wage cuts, furloughs, or headcount eliminations

- Extension of vendor terms for payment

- Renegotiation/moratorium of long-term fixed payment obligations

- Shutdown of plants and offices

- Alignment of cost structure with depressed revenue base

II. Managing through the Crisis

Once immediate measures have been taken to secure liquidity, a plan to sustain survival should be executed until the recovery phase is feasible. The plan should have at least 3 components and the following actions:

- Preserve Revenues:

- Identify potential revenue implications of the crisis by market and customer and review go-to-market approach

- Identify changes in revenue potential (given the crisis, some markets are becoming more attractive than others while others with good growth prospects pre-crisis are now on hold)

- Engage with key customers to understand situation, needs, risks and communicate company plan for business continuity

- “Do more with less” (Cost Discipline Initiative)

- Managing costs efficiently is easier when the entire organization is on board. A company-wide initiative to manage costs as efficiently as possible should be put in place while further identifying cost-reduction opportunities without affecting the business continuity required to execute the revenue plan

- The “Do more with less Initiative” must at least have the following components:

- Laser focused discipline in procurement

- X-ray the employee base and determine prioritized list of critical employees in case of a need for further labor reduction, optimizing both volume (# of FTE’s) and cost levels (wages + benefits)

- Optimize discretionary spend (contractors, marketing spend etc.)

- Continue Managing Cash and Invested Capital prudently

- Eliminate non-critical uses of cash

- Continue managing and looking for opportunities to reduce cash conversion cycle optimizing all available levers (Levels and terms for Receivables, Payables and Inventory)

- Review investment portfolio and postpone non-priority capital expenditures

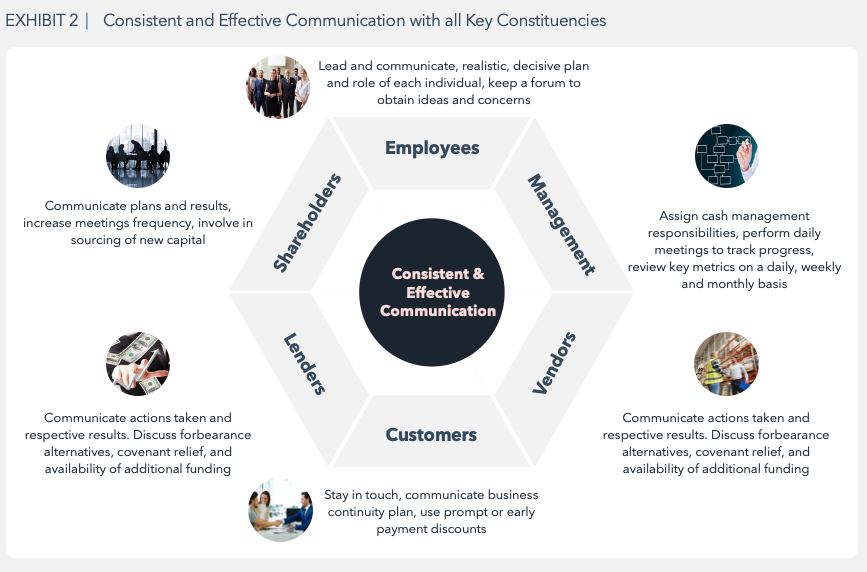

Periodic and Effective Communications with All Stakeholders

As plans are developed and more visibility is obtained, it is critical that communications take place with all constituencies of the business. In addition, it is also critical to install a Crisis Response Command Center that meets daily to address all parts of the plan. During times of physical separation, it is essential to go beyond the standard visual conference call, teams must use real virtual collaboration tools that enable visual dynamic problem solving and real-time management of tasks. EFESO has been facilitating teams using these types of tools for several years with great success.

Employees

- Leadership must be displayed

- Be realistic, but always encourage

- Provide a decisive plan forward

- Explain the part that each person must play

- Have a forum to obtain feedback and concerns

- Ask for ideas

Management

- Assign specific tasks related to conservation and determining sources of cash

- Have daily meetings to touch base and determine progress

- Hold individuals accountable for task execution

- Review important metrics in a dashboard format on a daily, weekly and monthly basis

- Communicate changes required because of new information obtained

Customers

- Stay in touch and continue to market with minimal expense to encourage a quick return

- Use prompt or early payment discounts to encourage quick collections of cash

- Provide comfort that the business will survive and is prepared for fast escalation of activity when conditions improve

Vendors

- Investigate inventory return rights to conserve cash expenditure for accounts payable

- Seek extended payment terms in return for price increases related to future purchases

- Obtain information regarding the financial viability of current vendors to determine whether replacement vendors will be needed

- Explain the company’s activities to withstand the crisis and remain financially viable

Lenders

- Start the dialogue immediately regarding the actions the company is taking

- Communicate frequent status reports on the results of actions taken

- Discuss issues regarding forbearance, covenant relief, and availability of additional funding for restructuring actions that will enhance financial viability

Owners (Board of Directors)

- Communicate on a scheduled basis, the survival and recovery plans and results to assure that there is alignment with management

- Consider increasing the frequency of formal meetings

- Enlist the assistance of Owners and Board members in finding sources of both debt and equity capital

- Provide timely and complete information to allow for fiduciary requirements to be met by Board Members and Owners

III. Recovery – Restructuring and Business Model Redesign

Once survival of the business is secured, and some predictability of future business activity is possible, the business must adapt to a scale that is affordable under projections of revenue and commercial activity. Under the current circumstances, when the COVID-19 crisis is over or at least manageable, businesses will be able to move forward. It is likely that the return to the level of pre-existing activity will take months, if not years. When this occurs, a complete restructuring of the business may be required.

The focus will then be on profitability as well as cash/liquidity management. A proper relationship must be established in the P&L components, matching expenses against expected revenues. This may require structural changes along with commercial and operational improvements.

Some of the restructuring activities that may be required during the recovery period are:

Structural Review

- Revision of strategy (where should we continue to play and how?)

- Product profitability analysis resulting in escalation or discontinuance of some products or services

- Disposition of non-performing business segments

- Footprint reduction

- Review target setting and business objectives

Commercial Review

- Review of target market and customer segments

- Revision of customer contract provisions

- Optimize Marketing plans

Operational Review

- Operational improvements to enhance competitive cost position

- Additional reductions in employment levels

- Redefining acceptable levels of working capital

Financing Review

- Refinancing of debt

- Optimization of capital structure

Restructuring and business model definition is very complex in both planning and execution. Consideration should be given to retaining legal, accounting, business and restructuring advisors. Large companies might have in-house resources to handle the complexity, but mid-market companies will be challenged.

About the Authors:

Tony Barone runs EFESO’s M&A and Restructuring practice. Before joining EFESO, he was an Operating Partner for two Private Equity firms, a CFO of three public companies, two in the US and one in Europe, and a CPA. [email protected]

Fernando Assens is EFESO’s Managing Partner and a co-leader of its Private Equity Practice. He focuses in Industrial and Distribution companies. [email protected]

David Bilby is a co-leader on EFESO Private Equity practice. Prior to joining EFESO, he was a Senior Director at Alvarez & Marsal. [email protected]

Jorge Mastellari’s background spans across multiple industries ranging from Industrials to Private Equity and Oil and Gas. Prior to joining EFESO, he was an Operations Consultant with McKinsey & Company. [email protected]

Fabian Rodriguez is a Vice President at EFESO’s Private Equity, M&A and Restructuring Practice. Prior to joining EFESO, Fabian was a Senior Vice President at Stern Stewart & Co. and a Senior Associate at A.T. Kearney. [email protected]