A Key Value-Creation Lever for Portfolio Companies

Problem:

Company transformations, optimized capital structures, and improved operations of portfolio companies are no longer enough to drive optimum value for private equity (PE) firms. They must increasingly consider sustainability, including product and value-chain decarbonization, to avoid financial risks and deliver expected value. Yet even though sustainability is rapidly changing markets, many PE firms are doing only what’s necessary to remain legally compliant while others are unnecessarily trading profitability for sustainability.

Solution:

EFESO helps PE firms holistically transform for sustainability — applying ESG in the operations of the PE firm, in their investment decisions, and in their portfolio companies — to maximize value creation, unlock more sales, reduce total costs, and deliver higher margins. Working alongside portfolio company management, we set a sustainability strategy to hit industry and region benchmarks and then execute to address:

- Sustainability regulatory requirements and risks (current and those to come),

- Customer demands for ESG-focused providers,

- Global markets that award companies that “do the right thing,”

- Investor funding requirements that increasingly evaluate a PE firm’s sustainability financial framework against investors’ own sustainability strategies, and

- Employees’ desire for sustainability practices, which increases engagement and a greater willingness to improve processes and add value.

These companies are building businesses to thrive in a circular economy; transforming operations and supply chains through reuse, refurbishing, recycling, and renewables; reducing emissions and energy consumption; and winning over sustainability-minded customers. EFESO is helping PE firms and their holdings identify and reduce risks, do less harm, and create more value as they go from gray to green.

Private equity (PE) firms typically have an economic horizon of five to seven years to maximize the value of the assets they hold or those they’re looking to acquire. They create value via company transformations, optimized capital structures, and increasingly operations improvements (e.g., transforming systems, processes, and practices to increase revenues and expand margins) while avoiding any risks that diminish value. In addition, they’re looking to identify all key value drivers to maximize returns on capital, secure additional funding, and attract new investors. And they increasingly have a new means to achieve all these objectives: sustainability.

Several PE firms — including Blackstone, Apollo, and KKR — have embraced sustainability as an approach to dramatically affect the value of their assets (existing or under consideration). They’ve identified how product and value-chain decarbonization unlocks more sales, delivers higher margins, and reduces total costs.

Yet while some PE firms are aware of the benefits of sustainability as a key value driver, and making changes accordingly, only a few are holistically transforming for environmental, social, governance (ESG): integrating ESG in the operations of the PE firm itself, integrating ESG in their investment decisions (choosing sectors that advance their ESG agendas), and deploying ESG in their portfolio companies to maximize value creation (improve growth, improve margins, and reduce risk). To the latter, many PE firms still look only at current legal compliance of their holdings (if that), instead of addressing more structural questions and issues:

- Sustainability regulatory requirements: Are they being met now and can they be met in the future? What happens to companies that don’t change from current practices? What are the risks?

- Customer requirements: Customers increasingly consider a company’s sustainability practices and performances. For example, they’ll reward contracts based on CO2 emissions data. In fact, some companies don’t conduct business anymore with counterparts that do not fully embrace ESG best practices.

- Market perceptions: When major competitors market themselves as “doing the right thing,” an entire industry begins to shift and others must catch up.

- Investor funding requirements: Investors (sovereign funds, pension funds, other PEs, individuals, etc.) will assess a firm’s sustainability financial framework as well as organizational alignment with their own sustainability strategies. The result: refinancing can be more difficult and expensive for those with non-sustainable holdings.

- Employee engagement: Labor forces are often directly impacted by sustainability practices, and workforces are more likely to be engaged in improving processes to add value if they recognize their company is pursuing sustainability goals.

Failure to address the above exposes PE firms to significant risk, and many of their portfolio companies are only now beginning to consider the strategic sustainability decisions to minimize them: e.g., where to source operations in the years to come and how to design production networks for ESG that leverage global supply chains and the renaissance of “trade-bloc thinking?” Billions are at risk in existing PE portfolios because sustainability performance has not been managed or only partly addressed.

EFESO is actively helping PE firms identify and profitably pull the right sustainability levers and avoid unnecessary risks. We understand the impact of sustainability on their portfolios, which can vary by industry and geography but are, nonetheless, relevant on a global basis. The goal is to actively manage sustainability for value creation, and, thus, positively impact growth and margins — wherever a portfolio company (PortCo) is on the spectrum toward sustainability:

- Some are still “business as usual” and need to begin to identify the potential sustainability risks that are arising.

- Many already have green strategies and goals — at year end 2023 more than 4,000 companies had science-based targets to reduce emissions[i] — but are challenged to progress toward their reduction targets and put in place an end-to-end sustainability program.

- Many have begun sustainability programs and are making progress toward goals, but they’re doing so in ways that drive up costs — swapping sustainability for profits.

- Few are addressing sustainability as a key performance indicator (KPI) for their businesses and pursing practices that enable them to profitably go from gray to green.

PortCo management teams are usually not prepared to address the complexities and sort through the multiple levers associated with profitable sustainability on their own. EFESO helps to establish a value-creating path with all three ESG dimensions. Given our experience with PE firms and sustainability, we’re able to identify benchmarks for what is possible and the most efficient means to execute. (Several EFESO clients have scored sustainability awards in Germany, Belgium, and other countries.) We can bring a strategic perspective to reinvent/reimagine the business for new definitions of success in the circular economy and make it happen, as opposed to throwing management teams a strategy and wishing them well. We have deep operations experience on the frontlines, improving plants, warehouses, and supply chains. We define and execute alongside clients with an action-oriented, operations-centric, value-deliver approach to achieving sustainability that rapidly enables PE firms to achieve tangible benefits for their portfolio companies:

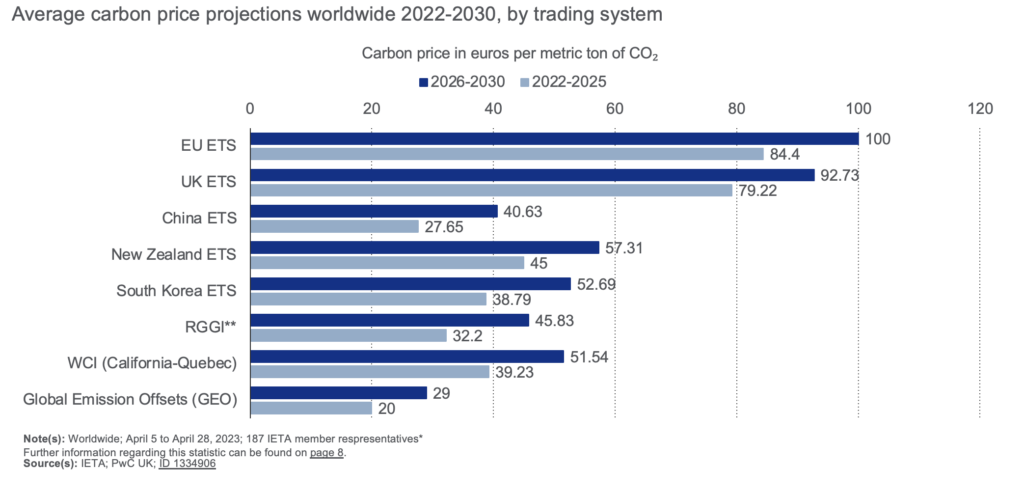

1.Maturity check — determine a company’s progress toward current sustainability requirements and standards (corporate carbon footprint, product carbon footprints), and also examine their readiness to address emerging rules and the impact this will have on the organization down the road. For example, emission allowances in Europe are approximately €70 per ton of CO2 produced, whereas CO2 costs in five years are conservatively projected to be as high as €100 per ton, with significant increases elsewhere around the globe (see Carbon Price Projections). And some estimates show current prices to at least double by 2030.Unless a company is acting today to bring down emissions for tomorrow, costs could be exorbitant and severely damage their financial position and growth. This not only impacts companies based in Europe where costs are highest and government is on the leading edge of sustainability regulations, but others — U.S. firms exporting goods into Europe as well as European firms relying on international suppliers. It’s a global operating environment.We apply an integrated perspective that breaks out and prioritizes emissions-related costs across the value stream and the improvement opportunities: product development/R&D, when many costs are typically designed in and difficult to alter after product launch; production process changes and equipment investments to reduce emissions; supply chain (recycled, recyclable, and renewable materials); product usage by customers; and end-of-life/circularity options (bringing products back for remanufacturing, thus decreasing dependence on carbon-heavy supply chains). This integrated approach quantifies the transition costs from gray to green while also uncovering traditional cost-optimization targets.

Carbon Price Projections

2.Transparency — EFESO consultants examine the integrity of a company’s public disclosure of decarbonization efforts relative to ESG rules and regulations (depending on the type of company, many are now subject to regulatory guidance). What companies communicate is becoming as important as their emissions-reductions effort and plans to achieve future goals. Mixed progress toward 2030 and net-zero targets for many companies calls into question the credibility of their ambitions, with many relying on false decarbonization solutions such as carbon capture, utilization, and storage (CCUS) standalone renewable energy certificates (RECs); bioenergy; and carbon dioxide removals as an alternative to actual emission reductions.[ii]Such “greenwashing” practices are becoming more difficult. The EU’s Corporate Sustainability Reporting Directive, enacted in 2023, requires all large companies and all listed companies (except micro-enterprises) to disclose the risks and opportunities arising from social and environmental issues and the impact of their activities on people and the environment; the law is intended to help investors and other stakeholders evaluate a company’s sustainability performances.[iii] The European Parliament passed legislation in early 2024 that will outlaw the use of terms such as “environmentally friendly,” “natural,” and “climate neutral” without evidence when describing products and services, and introduced a total ban on using carbon-offsetting schemes to substantiate the claims; only sustainability labels using approved certification schemes will be allowed.[iv] The U.S. Securities and Exchange Commission in March 2024 adopted rules to enhance and standardize climate-related disclosures by public companies and in public offerings.[v] This would apply to public PE firms, those going public, and PE firms that are Registered Investment Advisors.While some sustainability regulations don’t directly apply to all PE firms and their portfolios, they are driving ESG guidance and standards for PE firms and those investing in them. For example, Principles for Responsible Investment, which includes hundreds of PE firms and venture capital managers among signatories,[vi] developed a guide to help private equity general partners execute ESG stewardship of their portfolio companies.[vii]

3. Strategy — Based on the results of the maturity check and the transparency phase, we help PE firms establish a sustainability vision and strategy for the organization as well as their PortCos, plotting how the firm and holdings (factories, product and service offerings, supply chain) strategically transition in three to five years to a sustainable organization and do so without diminishing profits. This transformation plan is the response to a multidimensional problem that we help clients solve and varies by organization based on products and services; current gaps in addressing pollution, climate change, biodiversity, inclusion, etc.; risks on the horizon and ways to mitigate them; resources and investments needed to achieve the future state; and PortCo exit timing and potential impact on multiples. For example, a manufacturing company held for five years and producing complex industrial products may be locked into product designs, components, and materials for multiple years, thus restricting some near-term opportunities.We also align the cross-company and cross-departmental ESG transformation plan with the overall corporate strategy. The two cannot be independent; ESG objectives must get the same leadership and workforce attention as other strategic goals.

4. Governance — As the strategy gets rolled out, we define and deploy sustainability KPIs and work with PortCo management teams to define activities and timing to achieve KPIs. We identify optimal targets per area (where clients should go “all in”) and where it’s acceptable to deliver to the industry standard given costs and resources involved. This occurs as we establish a detailed action plan that addresses literally all facets of the ESG transformation: performance support (e.g., establish program plan and management, targets and objectives, tracking and evaluation methods, risk management); rollout support (e.g., develop an ESG toolbox, prioritize and drive initiatives); and anchoring support (e.g., analyze the current situation, develop the next future state, put in place a detailed communication plan for change, transform the culture).

5. Deliver — Unlike other advisory firms that cannot provide implementation support, during this phase we’re on the frontlines working with PortCo management to apply tools and methods to achieve ESG targets, including further definition and pursuit of bottom-up business-area targets, ongoing analysis and reaction to sustainability levers, and provision of data updates for corporate ESG reporting.

6. Stick — Our clients, with our support, continually improve sustainability of operations through innovation (hackathons/simulation games), employee development/training, and increased awareness.

ESG is a journey: EFESO starts the journey, directs the journey, and accelerates the journey by doing the implementation. Our work is foremost focused on the in E in ESG. But we also improve the S, guiding companies with human capital requirements, including having a more sustainable and engaged workforce that is willing to apply lean and best practices to achieve performance improvements. And throughout we work to ensure that our PE clients manage their firms and holdings in a responsible manner (G).

The EFESO Affect

PE firms and their PortCos can lose significant value if they ignore the risks associated with sustainability. EFESO has been helping PE firms identify and reduce risks and create value amid this new sustainability business landscape. We’ve provided our ESG expertise to PE firms and their holdings in a range of industries, including industrial equipment, business services, chemicals, and automotive (OEMs and suppliers). For example, for a PE client’s global automotive supplier, we helped them to “do less harm” while improving profitability:

- Established a global circular system for operations and piloted reuse, refurbishing, and recycling, which provided a 38% reduction in part costs as core components are reused;

- Transformed obsolete production processes, leading to an 80% reduction in CO2 emissions;

- Implemented practices and processes to reduce energy consumption and increase the use of renewables; and

- Improved operations across the value chain, resulting in higher delivery reliability, lower costs, and 60% higher customer satisfaction scores.

The PortCo’s CFO remarks that cost engineering has become a critical capability to secure margins and remain competitive, and EFESO was vital in setting up and rolling out that capability and “their best-in-class thinking makes all the difference for us.” Building on this, EFESO pioneered sustainability costing capabilities and incorporated those into our proven cost optimization and performance improvement structures that were developed decades ago.

For more than 20 years we’ve worked with PE firms and industrial investors. Our 900 consultants around the globe bring to clients deep operations experience and a wide range of technical and industry expertise, including an ability to minimize ESG complexity and risk, future-proof client operations, and swiftly and profitably help organizations go from gray to green.

About the Authors

Andreas Dörken, Partner– global leader of the Private Equity practice and the R&D/Innovation practices. He has more than 25 years of experience working in industrial firms and management consulting.

Jost Kamenik – CEO of TSETINIS-EFESO and member of EFESO‘s Global Management Committee , leads the Performance Improvement, CO₂ & Sustainability, and Cost Management practices. He has over 25 years of experience in performance and operations improvement, cost reduction, turnaround management, and energy management

Fabian Rodriguez, Partner– co-leads the Private Equity practice in North America and has over 20 years of global experience in value management, value strategy, and operations. Fabian is a trusted advisor and expert in maximizing company value.

Larry Keeley, Partner– co-leads the Private Equity practice in North America and has over 25 years experience in industry and management consulting partnering with C-level teams from leading companies across industries to optimize business performance.

[i] SBTi Monitoring Report 2023, Science Based Target Initiatives 2024.

[ii] “Corporate Climate Responsibility Monitor 2024,” New Climate Institute and Carbon Market Watch.

[iii] “Corporate Sustainability Reporting,” European Commission.

[iv] “Patrick Greenfield, “EU bans ‘misleading’ environmental claims that rely on offsetting,” The Guardian, Jan. 14, 2024.

[v]“SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors,” U.S. Securities and Exchange Commission, March 6, 2024.

[vi] Robert Eccles, Vinay Shandal, David Young, and Benedicte Montgomery, “Private Equity Should Take the Lead in Sustainability,” Harvard Business Review, July-August 2022.

[vii] “Stewardship in Private Equity: A Guide for General Partners,” Principles for Responsible Investment, March 27, 2024.