Operational Excellence 2.0 – Well Beyond Low-Hanging Fruit

Problem:

Private equity firms and industrial investors are holding on to portfolio companies for longer terms due to current market conditions (high interest rates, inflation, a deal-making slowdown, and depressed exit values). They recognize that value creation work previously undertaken to add value (Operational Excellence 1.0) is not enough. They’re willing to pursue more complex and higher risk/return initiatives (Operational Excellence 2.0) that typically take longer to execute but in many cases can be accelerated to deliver significant results for a potential near-term sale.

Solution:

An accelerated Operational Excellence 2.0 approach can quickly identify and capture the next wave of operational improvements to continue driving value creation beyond initial targets and quick wins. Focusing on opportunities with high impact to returns can achieve results in the timeframe needed by holding companies — a significant impact on exit valuation in as little as a year and even greater value for firms with longer holding periods. For private equity firms that believe they’ve reached their value-creation limits, there are five key areas for improvement we focus on that deliver tangible results:

- Accelerated Footprint optimization

- Maintenance and reliability programs (doing more with the same assets)

- Rapid lean transformations

- Product profitability and product portfolio management

- Innovation

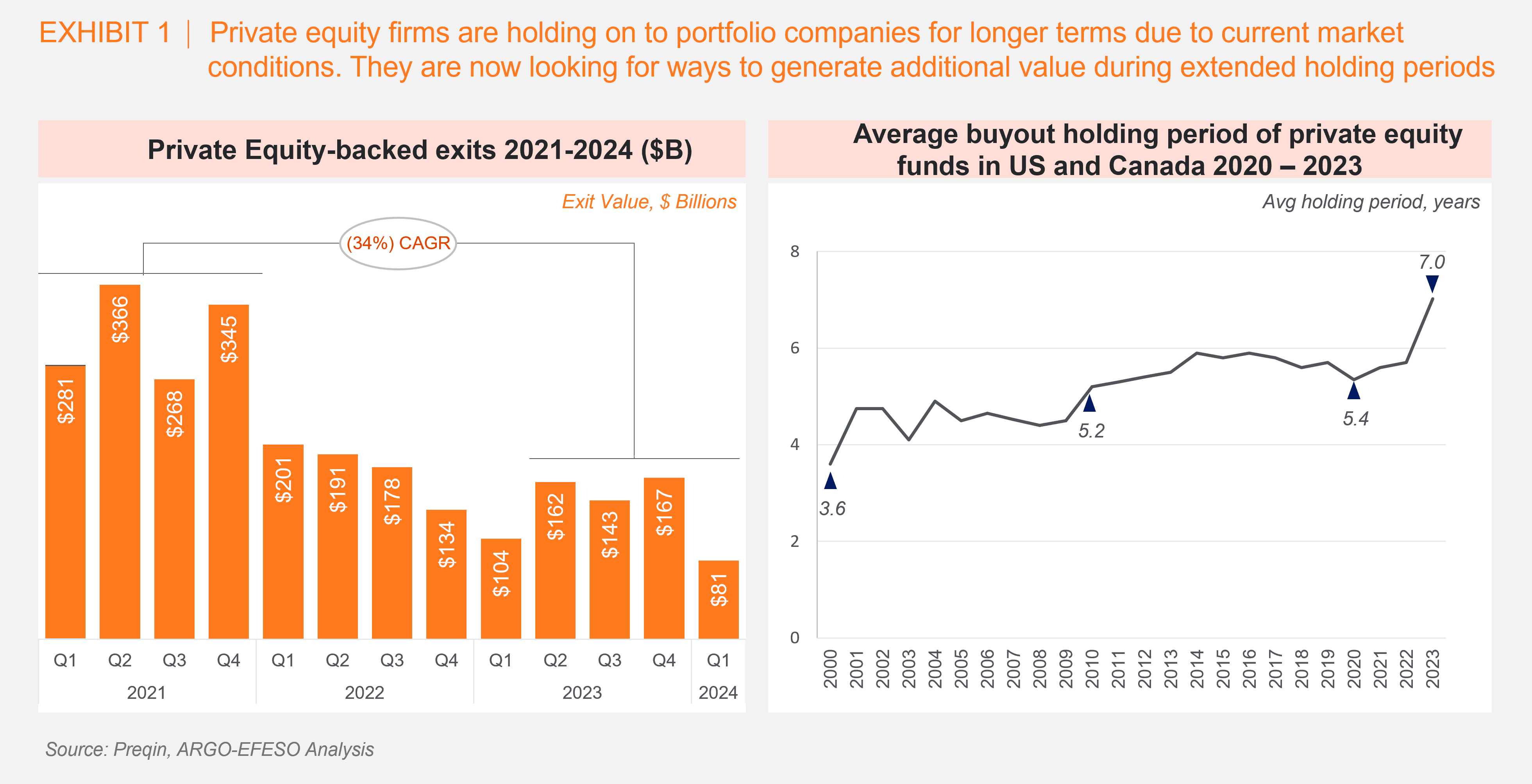

The current state of the private equity market in the U.S. and Europe — high interest rates, inflation, deal-making slowdown, and depressed exit values — is expected to prevail through 2024. This adverse exit environment is forcing private equity firms and industrial investors into longer holding periods (EXHIBIT 1). For many, they’re stuck with companies beyond their planned four-to five-year window and now looking for ways to rapidly generate additional value for a possible sale in the near future. Others are rolling over their investments, and giving themselves another long-term hold, but now with expectations to substantially add more value.

Private equity has not seen these conditions for decades. The problem in this new normal is that traditional methods of value creation — improved cost structures, financial leverage, and inorganic growth/bolt-ons — no longer suffice. Gains from earlier operations improvements (Operational Excellence 1.0), such as fundamental lean practices, strategic sourcing, headquarters and back-office rationalization, still need to be sustained but alone are not enough. What’s required is Operational Excellence 2.0 (OE 2.0). Private equity firms preparing for a near-term sale need fast value creation, and those holding a second term are looking to compound the growth previously achieved. We believe the best way to address both situations is with an aggressive OE 2.0 approach, one that delves into more complex improvements yet delivers optimal value at an accelerated execution pace.

Operational Excellence 2.0 Initiatives

Value creation plateaus in most industrial portfolio companies after four to five years. In our experience, the potential for increasing value beyond that time remains high, especially in five critical areas:

01. Accelerated Footprint Optimization

The assets of manufacturers and how they’re used (what they produce) frequently evolve based on near-term production needs and not on long-term strategic direction, resulting in underutilized plants and supply chains. This situation is exacerbated when the portfolio company has also been growing inorganically and/or through bolt-on acquisitions. Our teams have been able to realign assets of industrial companies in ways that lead to both fast value creation as well as establish a portfolio of plants and assets that deliver long-term success and improved returns on capital.

For example, in less than four months we reconfigured one client’s plant network. Production of high-volume, low-complexity products was transferred from a U.S. facility where margins have been flat to a Mexico facility where labor costs are a fraction of that found in the U.S. This immediately resulted in dramatically reduced manufacturing costs while increasing capacity in its U.S. facility for high-complex/high-margin products. This work could have not occurred without granular visibility into profitability to determine several potential actions (e.g., internal realignment, outsourcing, offshoring, plant process improvements).

Our analysis of manufacturing networks frequently leads to footprint optimization projects of portfolio companies that generally have too many production sites and/or suppliers. These high-impact efforts may require longer windows to realign products and technologies to sites, close or partially close facilities, restructure supply chains, and even consolidate production to new facilities. Yet these projects are especially attractive to private equity firms in a second term of holding assets with a previous cycle of robust inorganic growth. And as long as a company is generally free to allocate products to different facilities without customer approval, quick wins are absolutely possible from these and other moves.

02. Maintenance and Reliability Programs (Doing More with the Same Assets)

Successful sales strategies and growing sales volumes at portfolio companies can be constrained by production lines and equipment that aren’t reliable enough to keep up with rising demand. As industrial companies increasingly automate their operations, the more they need effective maintenance and reliability programs to prevent unscheduled downtime.

Maintenance and reliability programs will establish specific KPIs to drive changed maintenance behaviors and apply sophisticated tools to analyze machine data and prepare for equipment reliability prior to breakdowns. The goal is to move organizations from a reactive maintenance mindset to one focused on preventive and strategic practices, wielding a range of tactics.

The results from rapid maintenance and reliability programs can be a 30% to 50% reduction in unplanned downtimes. These short-term efforts also minimize wear and tear from machine breakdowns and minor stoppages, extending the life of capital assets and improving returns on capital. Longer-term approaches for reliability improvements include a review and revision of overall maintenance plans and schedules; spare-parts strategies (availability of replacements, repairable components, repair lead times); and five-year strategic plans that plot the turnaround dates for critical pieces of equipment. We typically supplement these analyses with big data and analytics to establish predictive maintenance behaviors.

03. Rapid Lean Transformations

Lean transformations are always a mix of practices that drive rapid and long-term improvements. We are helping manufacturers to rapidly execute improvements at a macro level (production lines) and micro level (workstations); train staff and embed daily routines to ensure practices are followed (standard work); and then apply the lean learnings and skills development to other parts of the organization.

KPIs should be established to monitor the improvements of lean initiatives (speed, cost savings, lead time, on-time delivery), hold management accountable, and reinforce systems and behaviors to independently sustain and extend positive outcomes. Digital tools for key management processes can be used to support visual management and standard operating procedures.

In one rapid lean transformation spanning just six months, we changed the flow of products through a company’s main plant; changed the flow of goods within workstations; and supported the new production layouts with digital tools to improve transparency and awareness of real-time performance. In half a year we were able to more than triple productivity (from 0.35 units per hour to 1.08 units); reduce rework by approximately 70% (4.5% to 1.4%); improve EBITDA margin by 700 basis points; and deliver the client a single year ROI on the project of more than 4X.

04. Product Profitability and Product Portfolio Management

Another powerful lever for additional value creation is to execute an accelerated process to achieve optimal transparency and visibility into product profitability: optimized pricing, improved manufacturing decisions, and an effective automation strategy are some of the typical byproducts of this initiative. Practical and economic-driven allocation and cost accounting reviews can provide a better understanding of supply-chain cost breakdowns throughout channel distribution, including reverse logistics, real profit and margin analysis, and product portfolio reviews.

Portfolio reviews represent a huge opportunity in large firms with multiple divisions, hundreds of products, and thousands of customers. Private equity firms rarely have assessed profitability by product or customer under a “true cost of complexity” perspective. For a high-tech company, our product profitability analysis identified a robust approach to maximize gross margin. With an offering of 1,200 active SKUs and >600 clients, we increased margins by 8.5 points through a series of portfolio actions. A product profitability analysis can quickly estimate the production costs of products and services at a very granular level, without the time-consuming configuration of enterprise IT systems. With this information, a company can confidently renegotiate prices with customers; discontinue products; offer new products to the customer in new ways; and realign their manufacturing footprint.

05. Innovation

Portfolio companies should approach innovation by developing efficient and cost-effective processes and techniques to close knowledge gaps and get more and better products to market faster. Changing the product and service development mindset and methods of an organization can take one to two years, but they also quickly deliver increased value by expanding R&D throughput (without expanding R&D staff).

In an era where resources are scarce, especially in R&D, and innovation cycles are shorter, manufacturers need to continuously improve throughput to sustain a full pipeline of projects and satisfy emerging demands. Lean product development impacts throughput in multiple ways, including:

- Portfolio management practices help R&D to estimate potential revenue and profits, ensuring only those projects that deliver optimum value to the product portfolio continue through to market. Many R&D departments don’t know how many projects they can deliver, let alone how many good projects. Our analysis and planning of R&D projects can quickly reduce costs by eliminating projects that will likely be unprofitable.

- Set-based design encourages R&D to manage multiple product variations early in development

(before large investments occur) and then gradually eliminate all but the best ideas through integration events involving perspectives and support from R&D, marketing, finance, production, procurement, etc. - Standardized projects and knowledge management and reuse help to minimize unnecessary work for which knowledge and technologies have already been developed by R&D.

Lean product development work also dramatically reduces time-to-market, which impacts revenue and profits from new products. New releases beat competitors to market and establish a longer window to attract customers without direct competition. Throughout the five focus areas, OE 2.0 helps companies get increasingly digital. Our projects in various industries have yielded in reduced time-to-market of 30-50%. The pace at which companies are redesigning and rethinking networks has dramatically accelerated in recent years. Leading-edge companies use game-changing analytics and decision-making capabilities to determine how and where they design, produce, and deliver high-quality goods and services at lower costs that generate greater value.

Time to Pursue OE 2.0

No one really knows how long the current private equity environment will last. But we do know that for the near-term, holding periods will be longer, requiring a value-creation approach demanding deeper intervention and new OE 2.0 initiatives. The alternative is stagnant growth, at best, and suboptimal returns. In this environment, private equity firms need expert support in operational areas to deliver additional value at pace.

About the Authors

Andreas Dörken, Senior Vice President – global leader of the Private Equity practice and the R&D/Innovation practices. He has more than 25 years of experience working in industrial firms and management consulting.

Dr. Thomas Troll, Senior Partner – leads the private equity practice in DACH region. He has more than 25 years experience in global operations strategy, footprint and transformation programs.

Fabian Rodriguez, Senior Vice President – co-leads the Private Equity practice in North America and has over 20 years of global experience in value management, value strategy, and operations. Fabian is a trusted advisor and expert in maximizing company value.

Larry Keeley, Senior Vice President – co-leads the Private Equity practice in North America and has over 25 years experience in industry and management consulting partnering with C-level teams from leading companies across industries to optimize business performance.

Raul Portela, Senior Adviser – leads the private equity practice in the United Kingdom. A former Private Equity Operating Partner with over 25 years in global executive roles, he concentrates on operational and commercial value creation opportunities.