An Independent, Effective Communication of a Company’s Current and Potential Performance to Maximize Exit Value

An Independent, Effective Communication of a Company’s Current and Potential Performance to Maximize Exit Value

Problem:

Private equity firms and industrial investors are struggling in the current market to get desired value from their exit deals. Sellers too often only react to buyers’ due diligence, a time-consuming and disruptive process that frequently uncovers company weaknesses and drives down sell prices.

Solution:

ARGO-EFESO conducts operational vendor due diligence that enables sellers to tell their data-driven story of operational success to buyers, which then streamlines the sales process and typically maximizes exit values. Our operations experts — tailored to a company’s industry and functional capabilities — detail current and potential performance of the company and give buyers confidence in the deal by presenting:

- A quantitative and qualitative assessment of operations and the continuous-improvement capabilities already in place.

- Opportunities for future value creation and a detailed plan to achieve it.

- Identification of value leaks and solutions for sellers to eliminate them prior to sale.

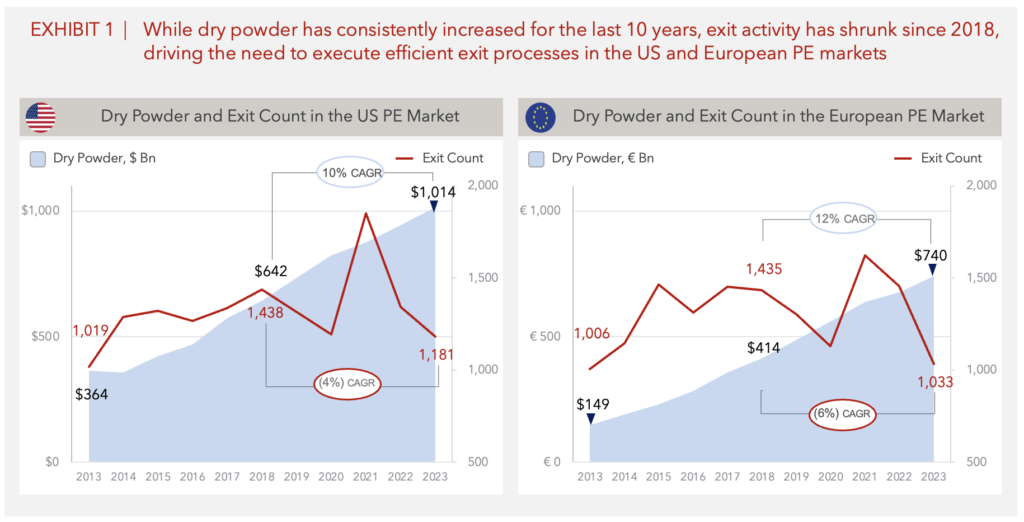

High interest rates, inflation, and diminished access to capital have led to market uncertainty, a slowdown in deal-making, and downward pressure on sellers’ exit values. Private equity firms and industrial investors, however, are still looking to sell efficiently and at top value, especially for holdings they acquired when prices were high (Exhibit 1). To maximize their exit values amid these challenging conditions, some firms have been wielding a more sophisticated selling approach — operational vendor due diligence.

Vendor due diligence gets deals done faster and achieves exit values for sellers that, more often than not, exceed expectations. Rather than react to buyer due diligence and the exhaustive questions and information requests that may disrupt operations, vendor due diligence puts sellers on offense, crafting a compelling value creation story, identifying and addressing value leaks, and conveying the value of current operations and the potential for additional value creation.

ARGO-EFESO brings to sellers an operations-focused vendor due diligence that potential buyers appreciate. We have worked with private equity firms and industrial investors for more than 20 years, and we’ve conducted hundreds of buyer due diligences. We understand what buyers will want to know and include that in our vendor due diligence reporting. We conduct vendor due diligence in any industry and have approximately 900 consultants around the globe with deep operations experience and a wide range of technical and industry expertise.

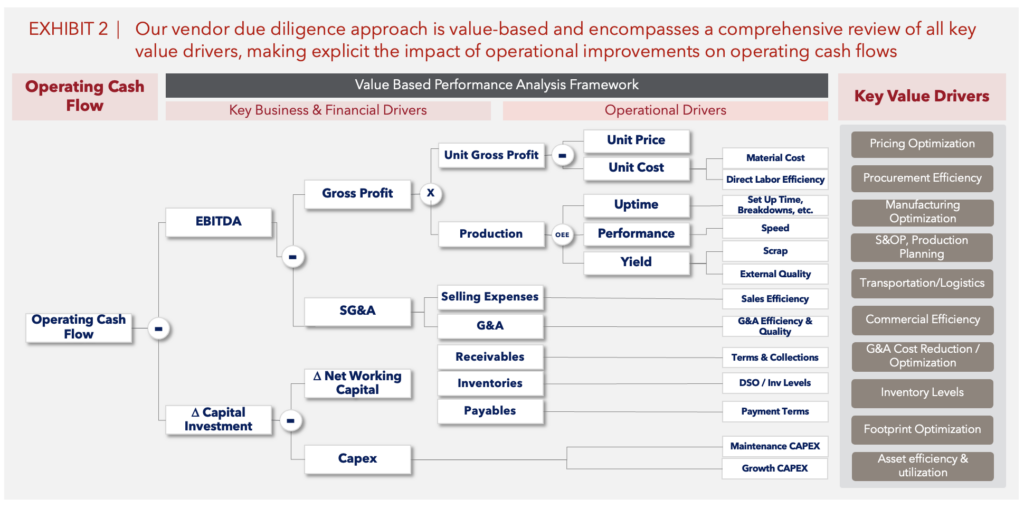

Instead of sellers relying on just a financial assessment of the company done by their management and investment bankers, our operations experts thoroughly assess, value, and communicate every key operational activity executed inside the company to generate free cash flow (Exhibit 2):

- Manufacturing facilities, including mapping the value stream, a thorough assessment of lean and operational excellence practices, and an examination of continuous improvement projects and benefits attained

- Manufacturing support functions (e.g., quality control, maintenance and safety practices)

- Supply chain and procurement activities, including visits to major supplier sites

- Product development and associated management process, including examination of product/portfolio costs and lean product development practices

- Performance management process, ownership culture, and quality of the leadership team

- SG&A functions (complete assessment of key functions with cost and organizational baselines and their improvement potential)

- Capital expenditures required by the company, including forecasted spending by year, category, and department

- Company-specific areas, such as the application of Industry 4.0 and sustainability practices and measures.

From our rigorous analysis, we structure an in-depth, independent vendor due diligence report that examines current operations and how they’ve been improved in recent years; presents value leaks (risks) and plans to address them promptly to minimize value erosion; and identifies opportunities for improvement that will create future value for buyers. ARGO-EFESO vendor due diligence enables sellers to tell buyers their own fact-filled value creation journey, establishing buyer confidence in management, the culture, and the improvements already in place as well as those still attainable. Most important, our work leads to successful, efficient, and faster deals that enhance exit value.

ARGO-EFESO Vendor Due Diligence Process and Outcomes

We tailor our multidisciplinary team to a seller’s operations and include relevant industry experts (e.g., chemical, F&B, industrial goods) and function/technical capabilities (e.g., maintenance experts for asset-intensive operations, innovation experts for businesses reliant on product development). Our team — led by dedicated SVPs/VPs and private-equity professionals — also includes financial expertise to align our operations analysis with financial and commercial due diligence done in preparation for the sale and to create a report with the financial findings and nomenclature expected by potential investors.

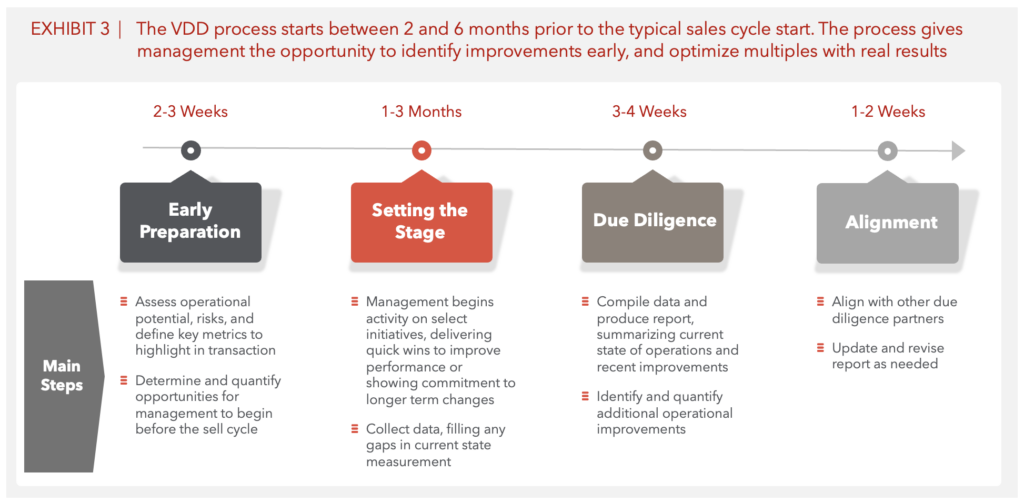

When a sales process has been initiated, the ARGO-EFESO team works with managing directors and operating partners of the seller and senior leadership at the target company. Our vendor due diligence process moves through four stages over two to six months; the length of engagements may vary due to functions assessed, company size, number of facilities to visit, complexity of operations, etc. (Exhibit 3).

ARGO-EFESO’s operations analysis incorporates three critical perspectives emphasized throughout the vendor due diligence report to give buyers a vivid picture of their acquisition and a well-lit runway for future growth and value creation:

- Assessment of Operations: We identify and analyze the key value drivers of the business to clearly explain and provide insights into operational performance, financial performance, and relative performance against the company’s key competitors. Operational KPIs typically include metrics for asset utilization (e.g., OEE), labor productivity (direct, indirect and SG&A), safety (e.g., incident rates), and product development (e.g., time to market) as well as measures for each function (e.g., unit material costs, unit labor costs).We also highlight key levers that have been improved to clearly show the company’s growth and efficiencies. Describing the history and context of improvements made over the past five years gives buyers confidence in the abilities of management to continuously improve operations and grow the company going forward.

- Opportunities for Value Creation: We present improvement opportunities, prioritized by cash flow impact and ease of implementation. Opportunities include quick wins, which the company often starts prior to sale in order to provide the buyer with evidence of value creation potential, and medium- to longer-term projects that promise the biggest upside for value creation, such as redesign of the product development process, product-cost management plans, manufacturing footprint and network optimization, equipment replacements, restructuring purchase processes, and large-scale strategic transformations (e.g., converting from a make to buy strategy).Our team quantifies the impact of the improvement opportunities in cash flow terms and structures a robust value creation plan. The opportunities we uncover are difficult for a seller or buyer to identify and quantify on their own. ARGO-EFESO uncovers transformational opportunities that require industry and/or operational expertise, and we present realistic plans that our history and expertise has demonstrated can be executed to achieve results.

- Value Leaks (Risks): When buyers conduct their due diligence, they are laser-focused on identifying issues that could impair their returns and give them reason to push down the sell price. Sellers shouldn’t hide risks because potential buyers are likely to find them, so we identify value leaks and put plans in place for the company to immediately begin mitigating them.We find the root cause of value leaks and help the seller to develop and execute effective mitigation plans to minimize value erosion. Value leaks that we’ve encountered include lack of execution capabilities (discrepancies in improvement plans vs. projects completed); lack of qualified personnel to execute the business plan; integration risks; supplier/material dependencies (overreliance on a few suppliers); and asset risks (suboptimal equipment conditions).

In addition to the credible, data-driven insights in the vendor due diligence report, we leave sellers with an organized data room of digital folders and subfolders containing all the information gathered in our analysis. Potential buyers are typically given access to the data room, which addresses many of their data requests and helps management quickly respond to any remaining needs.

Sellers shouldn’t wait for buyer due diligence to communicate their company’s performance history and future value-creation potential. With ARGO-EFESO they can take their exit process to the next level of excellence and maximize exit value. To accurately communicate the value of operations and improvement potential, sellers need operations experts. Relying only on commercial/financial advisors (lacking this expertise) will leave money on the table.

About the Authors

Andreas Dörken, Senior Vice President – global leader of the Private Equity practice and the R&D/Innovation practices. He has more than 25 years of experience working in industrial firms and management consulting.

Larry Keeley, Senior Vice President – co-leads the Private Equity practice in North America and has over 25 years experience in industry and management consulting partnering with C-level teams from leading companies across industries to optimize business performance.

Fabian Rodriguez, Senior Vice President – co-leads the Private Equity practice in North America and has over 20 years of global experience in value management, value strategy, and operations. Fabian is a trusted advisor and expert in maximizing company value.