Post-Acquisition Integration & Rapid Operational Improvement for a Bio-Tech Diagnostic Device Manufacturer

A Mid-Market provider of rapid diagnostic testing solutions applies ARGO-EFESO’s rapid improvement approach to integrate a new acquisition and capture value improvement opportunities in production, quality and supply chain

The Situation

A publicly traded manufacturer of Point of Care molecular diagnostic devices acquired a business unit of a major pharmaceutical company in 2018. The target was a leader in rapid diagnostic healthcare products, with a focus on cardio metabolic disease, infectious disease and toxicology. This unit was being divested as a result of a company merger with a European Competitor and to comply with antitrust provisions. Their main product was designed to aid in the diagnosis and risk stratification of patients having care issues, including congestive heart failure, acute coronary syndromes and others. Once integrated, our client was expected to double revenues to $500 million, achieve cost synergies of $18 million by the end of 2019 and add to their portfolio a series of promising testing devices.

Our client was looking to start the formal integration process as soon as the official close was reached; with minor disruption and optimal capture of deal value. An Integration Team was assembled and was starting the process of assessing the key elements required to achieve an effective transition on day 1. ARGO-EFESO was asked to join this team to confirm the synergies, prepare the implementation plan and lead the integration process, primarily in the operations and supply chain areas.

The acquisition target had sales of about $200 Million and 470 total employees. Our client’s management believed the manufacturing and supply chain operations of both companies to be equivalent. As such, they saw the potential to closely align and harmonize both their teams and processes. The jointly prepared integration plan targeted the following areas to reach the desired synergies:

- Rationalization of combined functions in Operations, Research & Development, Quality Assurance and General & Administration

- Manufacturing efficiency and yield improvements

- Vendor harmonization and procurement

ARGO-EFESO’s Solution and Implementation

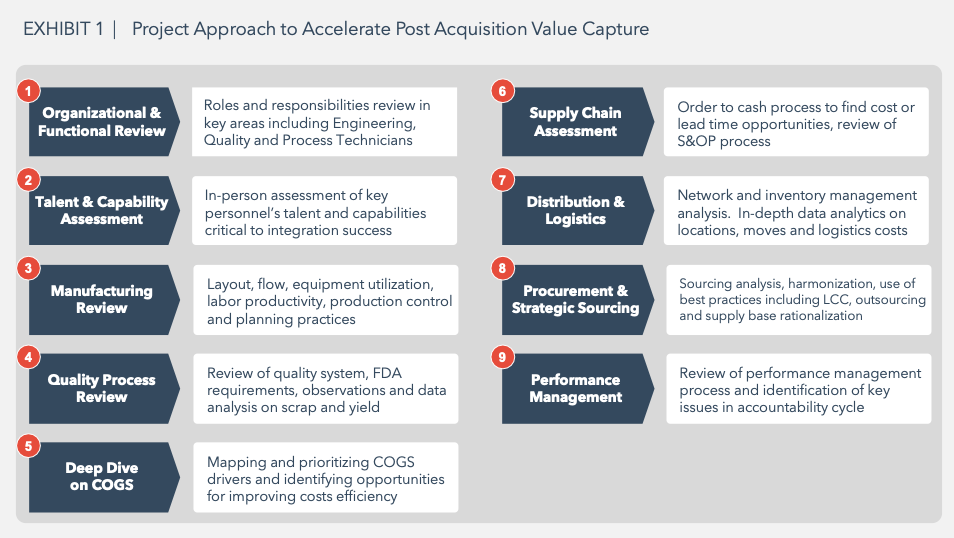

The first step was to execute a five-week deep dive analysis to confirm the opportunity and put together a capture plan. During this assessment the team fine-tuned a number of operational improvements confirming the original plan: duplicated roles and functions, unnecessary quality checks, unnecessary vertically integrated operations, distribution and inventory inefficiencies, ineffective use of temporary help and overall production yield and scrap issues.

To confirm those opportunities the deep dive included several business analyses as shown in Exhibit 1:

Key Findings

Variability in Manufacturing of Core Product: During the analysis, ARGO-EFESO became aware of the significant process control variability with the top sales product, a “cardio” device with impressive growth projections. Since inception, this device had not had a stable process. During 2012, FDA performance requirements were made more rigorous which increased the process checks and affected production yields. With “First Pass Yields” of less than 40% and significant growth projections, the losses were estimated in the millions

Suboptimal Manufacturing Model and Processes: The response to the lack of predictability caused by process control variability resulted in the evolution of the manufacturing model, starting with scheduling, to become a “just in case” model as compared to a “just in time’ model. This operating concept extended to warehousing and the supply chain. Therefore, stock levels in the value stream were extremely high not just impacting cash flow but also warehouse space, operations and inspection requirements.

Spend Consolidation Opportunities in Procurement: Procurement was also confirmed as an area of opportunity, with a total combined spend (direct and indirect) of $54 Million and with 35% associated to common suppliers. ARGO-EFESO identified opportunities to leverage common suppliers and negotiation power. Equally important, gaps were identified in the process for commodity stratification and supplier management as well as opportunities for organizational realignment.

Asset Consolidation Opportunities in Distribution and Logistics: The distribution and logistics environment was analyzed, and this revealed additional benefits. The combined company had a total of 6 warehouse locations in the San Diego area for storage, distribution, light assembly and packaging operations. The team developed a number of network and logistics scenarios which confirmed that the consolidation of the two largest DC’s was possible without impacting performance and with almost $3 Million in savings.

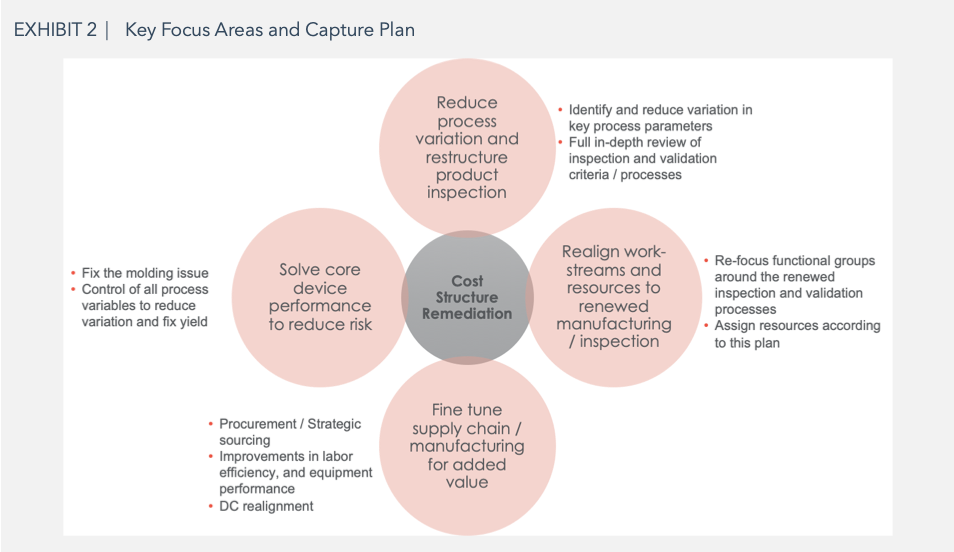

The Capture Plan: The ARGO-EFESO – Client team put together an 8-month plan to capture all the integration opportunities. This deep dive was critical to bring the internal team together around the feasibility of the integration initiatives and to jointly validate savings in the range of $10 – $12 million by focusing on the following work-streams:

Cost structure remediation

- Reduce process variation and re-structure product inspection and validation

- Realigned work streams and resources to renewed manufacturing and inspection

- Fine tune supply chain and manufacturing for additional value

- Solve core device performance to reduce risk

The implementation moved forward and separate teams were chartered to work on the opportunities. ARGO-EFESO installed a Command Center methodology to check progress daily and weekly using a visual methodology. During 2018 the teams made strides on the following work-streams which ultimately generated $11.2 millions of profit improvement as summarized in Exhibit 3:

The implementation moved forward and separate teams were chartered to work on the opportunities. ARGO-EFESO installed a Command Center methodology to check progress daily and weekly using a visual methodology. During 2018 the teams made strides on the following work-streams which ultimately generated $11.2 millions of profit improvement as summarized in Exhibit 3:

Testimonial

My company’s team was very impressed with the people, process discipline and innovative thinking that ARGO-EFESO brought to assist in the acquisition integration. Their approach to problem solving and aligning the team made a big difference in making the changes required. ARGO-EFESO provided coaching and leadership on best practices that made us confident in our ability to capture synergy expectations. The company made rapid improvements in production, quality and supply chain.

-Tony Cunningham, Senior Director of Supply Chain

ARGO-EFESO’s expertise in Mid-Market acquisition integration and restructuring combined with years of experience in the life sciences and medical device sector, allowed for a nimble and successful integration of these two companies in a period of 10 to 12 months.

The 8 initiatives selected during the assessment had an EBITDA Impact of over $11 million and a cash flow impact of over $13 million.

ARGO-EFESO worked hand in hand with the client’s team to accelerate the capture of the improvements while advising and executing effective change management actions and implementing sustainment mechanisms. During 2019 and in 2020, the client has positioned itself as a leader in the testing device sector with a stable portfolio of traditional products and with a successful pipeline of new products. The stock price has increased by more than three times since the time of the acquisition.

About the Authors:

Jorge Mastellari’s background spans across multiple industries ranging from Automotive, Electronics and Medical Devices to Private Equity and Industrials. Prior to joining ARGO-EFESO, Jorge was a Project Manager with McKinsey & Company. [email protected]

Fernando Assens is ARGO-EFESO’s Managing Partner and a co-leader of its Private Equity Practice. He focuses in Industrial and Distribution companies. [email protected]

Tony Barone runs ARGO-EFESO’s M&A and Restructuring practice. Before joining ARGO-EFESO, he was an Operating Partner for two Private Equity firms, a CFO of three public companies, and a CPA. [email protected]

Fabian Rodriguez is a Vice President at ARGO-EFESO’s Private Equity, M&A and Restructuring Practice. Prior to joining ARGO-EFESO, Fabian was a Senior Vice President at Stern Stewart & Co. and a Senior Associate at A.T. Kearney. [email protected]